HOWELL, NJ – May 15, 2019: The founder of one of America’s largest commercial real estate financing firms has launched a new, separate company that educates the public about the power of lending as a pathway for commercial real estate investment – and then helps individuals become actual lenders.

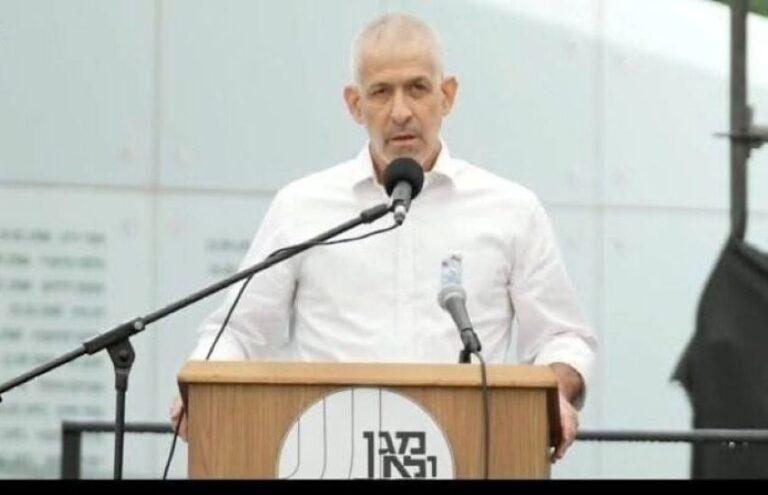

Ira Zlotowitz, founder and president of Eastern Union, which this month marked its 18-year anniversary, launched the new firm, The Ira Group. Eastern Union, which continues to be led by Mr. Zlotowitz, closed a total of $12 billion in debt and equity financing over the past three years.

Focused on the lending side of the real estate investment equation, The Ira Group’s target market includes both those with past lending experience, as well as newcomers to the world of commercial real estate lending. The new company will be engaged in opportunities extending across a full spectrum of risk and return.

To introduce The Ira Group to the marketplace, Mr. Zlotowitz will personally host a 60-minute seminar that educates attendees about the highly viable option of becoming a lender, and spells out the specific steps participants can take to join the ranks of syndicated lenders at various levels of risk.

He will present the seminar on Wednesday night, May 29 in Lakewood, NJ and on Wednesday night, June 5 in Israel. Participants may attend in person, or they may take part in an interactive webinar format from any location via streaming. Interested parties can register for either seminar by visiting The Ira Group.

“We are educating the public to the fact that investing in real estate is not the only way to benefit from commercial real estate,” said Mr. Zlotowitz. “You can also be a private lender.

“As the first component of our two-part business model, we educate people about the benefits of lending as a secure pathway to investment success,” said Mr. Zlotowitz, who has trained more than 4,300 people in commercial real estate financing via online and in-person seminars, courses, internships, and within Eastern Union.

“People generally think that you have to be a banker to be a lender, but that’s not so,” he said. “It isn’t difficult for individual people to be lenders, too, and we will educate you about how to do it.”

“As the second component of its business model, The Ira Group introduces prospective lenders to other lenders offering opportunities covering a wide range of risk levels,” said Mr. Zlotowitz. “We understand how most people are not in a position to set something like this in motion by identifying, funding, and servicing loan opportunities on their own.

“After we have educated you to the fact that lending is a real and serious option, you will have the opportunity to meet with other lenders who are actively assembling a team of co-lenders all focused on a particular asset.”

Eastern Union, he explained, concentrates on conventional, “business-to-business” real estate mortgage brokerage models through which borrowers are introduced to lenders that match their borrowing needs.

By contrast, The Ira Group employs a “consumer-to business” approach that makes introductions that then allow individual, private lenders to collectively participate in a syndicated loan being packaged by a private, public, or institutional “hard-money” lender serving as the lead lender or syndicator. Participating consumers may choose their own preferred risk level, typically within the scope a single transaction. The level of risk can extend from a conventional, four- to five-percent range up to returns reaching twelve percent or more.

Risk levels generally reflect the individual lender’s proportional participation within a particular, overall transaction syndicated by the hard money lender. Rates starting at four to six percent, for example, would generally be available to loan participants taking on less than fifty percent of the asset’s total value. While some participants may lend at amounts in the $250,000 range, others may lend at a level as low as $25,000.

“You don’t have to own an asset to reap the financial benefits of commercial real estate investment,” said Mr. Zlotowitz. “Lending is a smart option, yet too many people simply don’t realize that it’s a real and viable option. Designed for veteran players or first-timers, this time-tested doorway into real estate makes it easy and manageable to join the ranks of successful lenders.”

About The Ira Group

The Ira Group provides syndicated lending opportunities to both experienced and first-time lenders in the commercial real estate marketplace. Ira Zlotowitz, president and founder of Eastern Union, one of America’s largest commercial mortgage brokerage companies, founded the company.

The Ira Group educates prospective lenders about the benefits of lending, and then introduces prospective lenders to other lenders. Lenders then have the option of participating on a syndicated basis at a full range of risk levels, with higher risk amounts earning higher yields.

For more information about The Ira Group, please contact Aaron Eller at 732-719-5200 or at [email protected].

One Response

Is it ribbis?