International rating agency Moody’s downgraded Israel’s credit outlook from positive to stable on Friday but left Israel’s credit rating unchanged at A1.

“The change of outlook to stable from positive reflects a deterioration of Israel’s governance, as illustrated by the recent events around the government’s proposal for overhauling the country’s judiciary,” Moody’s stated. “While mass protests have led the government to pause the legislation and seek dialogue with the opposition, the manner in which the government has attempted to implement a wide-ranging reform without seeking broad consensus points to a weakening of institutional strength and policy predictability.”

“The government has reiterated its intention to change how judges are selected. This means that the risk of further political and social tensions within the country remains. On the upside, if a solution is reached without deepening these tensions, the positive economic and fiscal trends that Moody’s had previously identified remain. All in all, the recent events offset the positive developments that had led Moody’s to assign a positive outlook in April 2022, which related to strong economic and fiscal performance and the implementation of structural reforms by the previous government.”

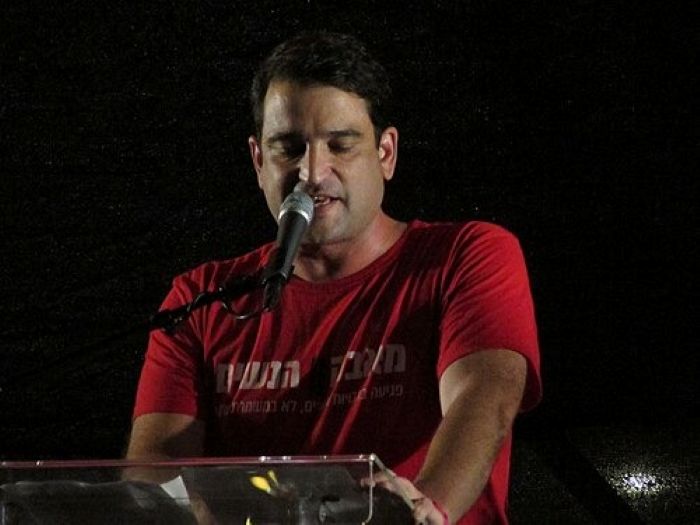

Prime Minister Binyamin Netanyahu and Finance Minister Betzalel Smotrich responded to the announcement by stating that “Israel’s economy is stable and strong and b’ezrat Hashem will remain so. The analysts of the Moody’s rating agency correctly recognize the strength of the Israeli economy in all indicators and our responsible economic leadership in the wise management of public spending and the promotion of reforms that encourage growth.”

“The concern raised by Moody’s analysts about the public controversy and its effect on Israel’s political and economic stability is natural for those who aren’t aware of the strength of Israeli society. As those who believe in the strength of Israeli society, its unity and its ability to overcome disputes and crises, as we have done many times in the past, we are convinced that b’ezrat Hasehm, this will be the case this time as well. The State of Israel is a strong democracy and as a result, the citizens of Israel hold fiery discussions on issues that are a source of contention within Israeli society – which is a sign of the strength of Israeli democracy.”

“By their nature, intense political disputes lead to protests and can create temporary uncertainty. These are risks that are taken into account and hedged within the economic assessments of the State of Israel. There will be no damage to Israeli democracy and the Israeli economy. We will continue to lead a responsible economic, security and social policy and do everything for a stable, growing and thriving Israeli economy.”

(YWN Israel Desk – Jerusalem)

6 Responses

A dysfunctional political system is a liability even with a strong economy. The fact that the rich people are threatening to leave if response to the government’s social policies is a serious issue.

Akuperma is 100% correct regarding how Moody’s and S&P consider near-term internal political stability in their credit risk outlook. Any factors which could affect the timing and outcome of budgetary and and financial decisions in the Knesset are a negative factor and routinely result in adjustments to national ratings. Clearly, recent political events are among the most contentious in the history of EY and Moody’s decision to make a slight downward adjustment is a routine outcome following their normal rating protocols.

The State of Israel is a strong democracy and as a result, the citizens of Israel hold fiery discussions on issues that are a source of contention within Israeli society – which is a sign of the strength of Israeli democracy.”

“By their nature, intense political disputes lead to protests and can create temporary uncertainty. These are risks that are taken into account and hedged within the economic assessments of the State of Israel. There will be no damage to Israeli democracy and the Israeli economy.” Great article!

I trust Moody’s Israel credit system as much as I trust their credit rating system for mortgages in 2008. Oh wait…..

https://www.theguardian.com/business/2017/jan/14/moodys-864m-penalty-for-ratings-in-run-up-to-2008-financial-crisis#:~:text=6%20years%20old-,Moody's%20%24864m%20penalty%20for%20ratings%20in,up%20to%202008%20financial%20crisis&text=The%20credit%20rating%20agency%20Moody's,of%20justice%20said%20on%20Friday.

If the left can’t win at the ballot box they will threaten the economy to bring down a legitimately elected prime minister. The very antithesis of the democracy they are claiming to champion.

“I trust Moody’s Israel credit system as much as I trust their credit rating system for mortgages in 2008….

I don’t think global capital markets care about YOUR level of trust in Moody’s ratings dynamics. A credit downgrade or a negative risk outlook will result in hundreds of millions of NIS in additional borrowing costs unless their is a negotiated resolution of the current political upheaval.