Federal Reserve Chairman Ben S. Bernanke said the central bank has the tools to prevent the U.S. economy from slipping back into a recession, while stopping short of indicating an immediate need for more stimulus.

Federal Reserve Chairman Ben S. Bernanke said the central bank has the tools to prevent the U.S. economy from slipping back into a recession, while stopping short of indicating an immediate need for more stimulus.

Bernanke presented a scenario for continued expansion as households rebuild their savings, banks increase lending and companies become more willing to hire. Stocks jumped and Treasuries fell as he said “the preconditions for a pickup in growth in 2011 appear to remain in place” and rebuffed skeptics who argue the Fed is out of ammunition.

“The issue at this stage is not whether we have the tools to help support economic activity and guard against disinflation. We do,” Bernanke said in a speech yesterday to central bankers and economists at the Fed’s annual conference in Jackson Hole, Wyoming, detailing choices that include renewed large-scale securities purchases.

“Bernanke expressed a willingness to provide further monetary accommodation, if necessary, but did not signal that any such decision was a done deal,” said Michael Feroli, chief U.S. economist at JPMorgan Chase & Co. “The September meeting may be too soon to expect a major policy action, though we would not rule that out if the data continues to disappoint.”

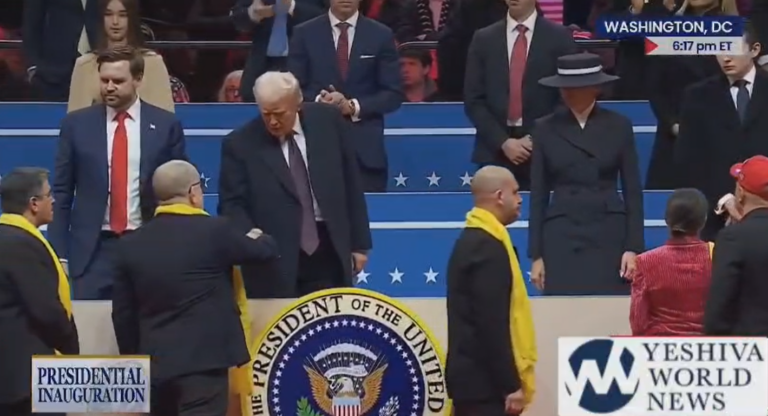

(Source: Bloomberg News)

One Response

What he is doing is basically running a gemach (free loan fund – almost interest free ) for banks, and funding it with “printed” money (okay, not actually printed, though the money was “created” out of thin air with nothing backing it). Why should banks pay savers good interest for deposits (when real people loan banks money), when the Fed loans them money for free?

Reducing taxes would help more, but that’s the responsibility of the President and Congress.