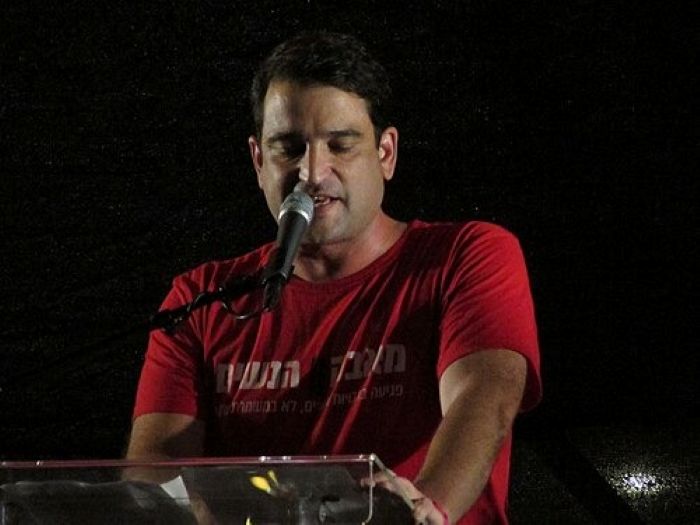

Isaac Yedid, Esq. & Raymond Zeitoune, Esq.

Isaac Yedid, Esq. & Raymond Zeitoune, Esq.

With careful Medicaid planning, you may be able to preserve some or all of your estate assets for your children or other heirs while meeting the Medicaid asset limit.

The problem with directly transferring assets to another person’s name is that you immediately give away these assets “today” as opposed to when your pass away. A safer approach is to put them in an irrevocable trust. A trust is a legal entity under which one person — the “trustee” — holds legal title to property for the benefit of others — the “beneficiaries.” The actual assets are usually not transferred to the name of the beneficiaries until after your death. The trustee must follow the rules provided in the trust instrument. Whether trust assets are counted against Medicaid’s resource limits depends on the terms of the trust and who created it.

A “revocable” trust is one that may be changed or rescinded by the person who created it. Medicaid considers the principal of such trusts (that is, the funds that make up the trust) to be assets that are countable in determining Medicaid eligibility. Thus, revocable trusts are of no use in Medicaid planning.

Income-only trusts

An “irrevocable” trust is one that cannot be changed after it has been created. In most cases, this type of trust is drafted so that the income is payable to you (the person establishing the trust, called the “grantor”) for life, and the principal cannot be applied to benefit you or your spouse. At your death the principal is paid to your heirs. This way, the funds in the trust are protected and you can use the income for your living expenses. For Medicaid purposes, the principal in such trusts is not counted as a resource, provided the trustee cannot pay it to you or your spouse for either of your benefits. However, if you do move to a nursing home, the trust income will have to go to the nursing home.

You should be aware of the drawbacks to such an arrangement. It is very rigid, so you cannot gain access to the trust funds even if you need them for some other purpose. For this reason, you should always leave an ample cushion of ready funds outside the trust.

You may also choose to place property in a trust from which even payments of income to you or your spouse cannot be made. Instead, the trust may be set up for the benefit of your children, or others. These beneficiaries may, at their discretion, return the favor by using the property for your benefit if necessary. However, there is no legal requirement that they do so.

One advantage of these trusts is that if they contain property that has increased in value, such as real estate or stock, you (the grantor) can retain a “special testamentary power of appointment” so that the beneficiaries receive the property with a step-up in basis at your death. This will also prevent the need to file a gift tax return upon the funding of the trust, as well as hopefully help your beneficiaries from the need to pay a capital gains tax if the property is sold right after your death.

Remember, funding an irrevocable trust can cause you to be ineligible for Medicaid for the following five years (AKA “The Five Year Look Back Rule”).

Testamentary trusts

Testamentary trusts are trusts created under a will. The most common testamentary trust is the credit shelter bypass trust also known as the AB trust. The Medicaid rules provide a special “safe harbor” for testamentary trusts created by a deceased spouse for the benefit of a surviving spouse. The assets of these trusts are treated as available to the Medicaid applicant only to the extent that the trustee has an obligation to pay for the applicant’s support. If payments are solely at the trustee’s discretion, they are considered unavailable.

Avoiding the five year look back rule

The Medicaid rules also have certain exceptions for transfers made to certain individuals which would allow the Medicaid applicant to avoid ineligibility because of the five year look back rule. Therefore, it is possible to have a Medicaid trust without the imposition of a penalty period if the transfer is made to: (i) a qualifying relative; (ii) your child who is either under 21 years of age, blind or permanently disabled; (iii) your sibling, if he or she has an equity interest in the house and was living there for at least one year before you went into a nursing home; or (iv) your adult child, if that child has lived in the home at least two years before you went into a nursing home and that child was taking care of you.

Conclusion

Speaking with an experienced trusts and estates/elder attorney will be useful to you because the attorney will advise you on the options available to you which will allow you to use Medicaid to cover the cost of medical care without depleting your assets. In addition, planning in advance is a good option because the penalty period will likely expire before you may need to be admitted to a nursing home.

Forming a New York Medicaid trust allows you to protect your family’s assets from being used to pay for your medical and nursing home care by justifying the need to receive Medicaid in the future to cover those expenses.

May we all merit living long, healthy and happy lives – amen.

_________________________________________________________________________________________________________________________________________________

The attorneys in the Corporate Practice Group and the Tax Practice Group at Yedid & Zeitoune have over a combined 20 years of legal experience and are ready to assist you with all your corporate/tax needs.

Isaac Yedid, Esq. and Raymond Zeitoune, Esq.

Yedid & Zeitoune, PLLC

1172 Coney Island Avenue Brooklyn, New York 11230

Phone: (347) 461-9800 Fax: (718) 421-1695 Email: [email protected]

NYC Office – By Appointment Only:

152 Madison Avenue, Suite 1105 New York, New York 10016

_______________________________________________________________________________________________________