CitiMortgage and CitiFinancial North America announced Thursday that they were suspending foreclosure sales and evictions for first mortgages they own so that homeowners nationwide with troubled mortgages can stay in their homes for the holidays.

CitiMortgage and CitiFinancial North America announced Thursday that they were suspending foreclosure sales and evictions for first mortgages they own so that homeowners nationwide with troubled mortgages can stay in their homes for the holidays.

Both CitiMortgage, based in O’Fallon, Mo., and CitiFinancial are units of New York-based financial services giant Citigroup.

Borrowers with first mortgages owned by the units and who meet certain criteria won’t be subject to foreclosure sales or notifications during a 30-day suspension effective Friday through Jan. 17, 2010.

The foreclosure suspension affects only loans owned by Citi, or about 20 percent of its $746 billion mortgage servicing and lending portfolio, the company said.

Citi said it expects the suspension will affect about 2,000 borrowers scheduled to have foreclosure sales and another 2,000 who were to get foreclosure notices in the next 30 days.

Citi’s existing Homeowner Assistance Program, a foreclosure prevention initiative, has helped about 715,000 homeowners avoid foreclosure since the housing crisis began in 2007, the company said in a release.

The company said it does not initiate or complete a foreclosure sale on eligible borrowers if Citi owns the mortgage, the borrower is seeking to stay in a home that’s the borrower’s primary residence, and if the borrower is working in good faith with Citi and has enough income for affordable mortgage payments.

(Source: Biz Journals)

One Response

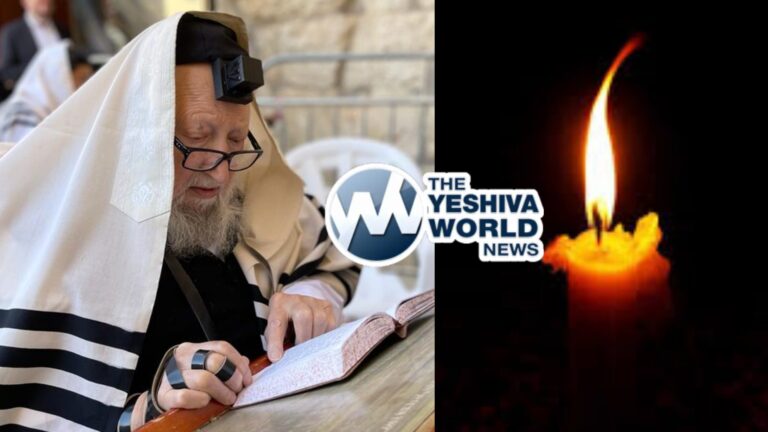

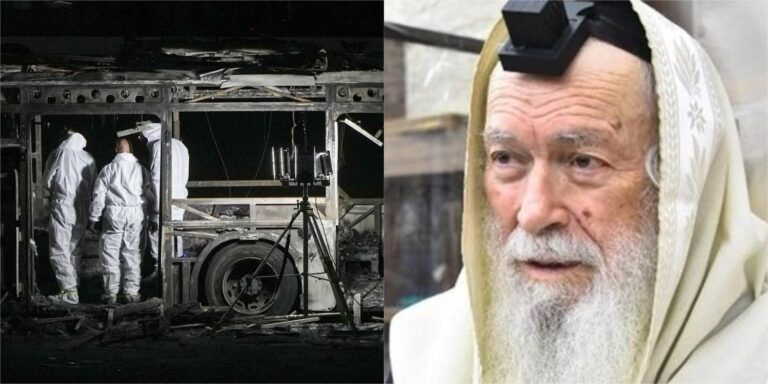

Medina Shel Chesed….