President Donald Trump slammed Federal Reserve Chair Jerome Powell on Thursday, reiterating his frustration that the Fed has not aggressively cut interest rates and saying that the central bank leader’s “termination cannot come fast enough.”

Trump hinted at moving to fire Powell, whose term does not expire until next year. The Republican president’s broadside comes a day after Powell signaled that the Fed will keep its key interest rate unchanged while it seeks “greater clarity” on the impact of policy changes in areas such as immigration, taxation, regulation and tariffs.

Powell’s comments contributed to a drop in stock prices Wednesday.

“Oil prices are down, groceries (even eggs!) are down, and the USA is getting RICH ON TARIFFS,” Trump said in a social media post.

Referring to the European Central Bank, he added that Powell “should have lowered Interest Rates, like the ECB, long ago, but he should certainly lower them now. Powell’s termination cannot come fast enough!”

The European Central Bank on Thursday lowered its key interest rate from 2.5% to 2.25%.

Powell was initially nominated by Trump in 2017, and he was appointed to another four-year term by President Joe Biden in 2022. At a November news conference, Powell indicated he would not step down if Trump asked him to resign.

He has also said that the removal or demotion of top Fed officials was “not permitted under the law.”

Trump’s comments come with the backdrop of a legal case headed to the Supreme Court that could determine whether presidents can fire the heads of independent agencies such as the Fed. Powell said Wednesday he was watching the case.

“A sudden crystallization of the threat to Fed independence would … intensify market stress,” Krishna Guha, an analyst at investment bank Evercore ISI, wrote on Thursday. “If you liked the tariff debacle in markets, you’d love the loss-of-Fed-independence trade.”

Powell started Trump’s second term in a relatively secure spot with a low unemployment rate and inflation progressing closer to the Fed’s 2% target, conditions that could have spared the U.S. central banker from the president’s vitriol.

But Trump’s aggressive and haphazard tariffs have increased the threat of a recession with both higher inflationary pressures and slower growth, a tough spot for Powell, whose mandate is to stabilize prices and maximize employment. With the economy weakening because of Trump’s choices, the president appears to be looking to pin the blame on Powell.

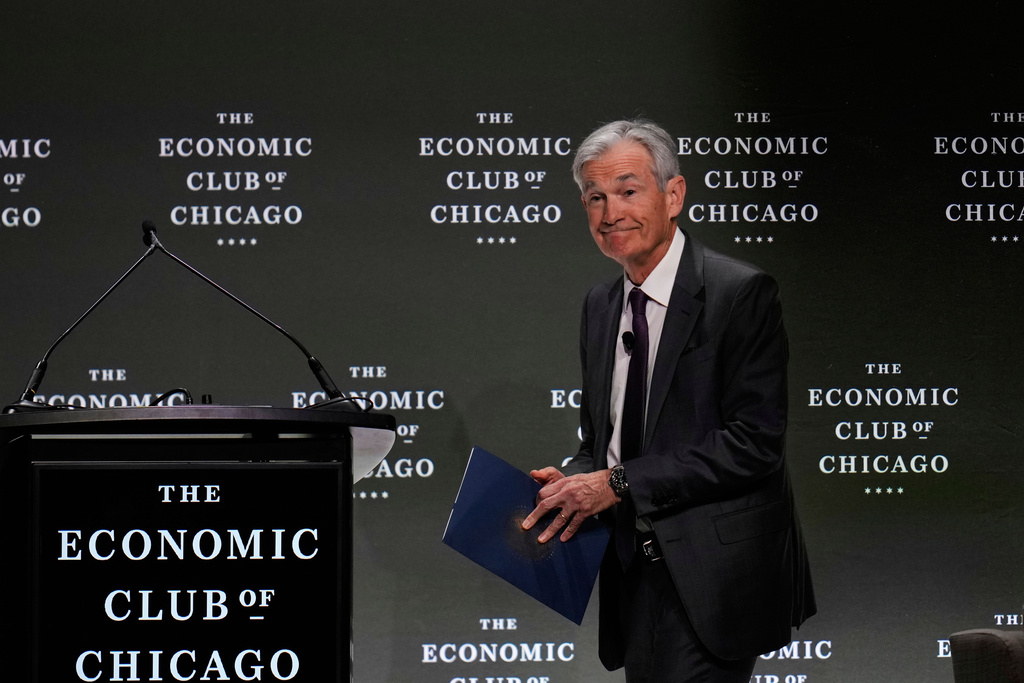

Powell, in his remarks at the Economic Club of Chicago on Wednesday, said the Fed will base its decisions solely on what is best for all Americans.

“That’s the only thing we’re ever going to do,” Powell said. “We’re never going to be influenced by any political pressure. People can say whatever they want. That’s fine, that’s not a problem. But we will do what we do strictly without consideration of political or any other extraneous factors.”

“Our independence is a matter of law,” Powell continued. “We’re not removable except for cause. We serve very long terms, seemingly endless terms. So we’re protected into law. Congress could change that law, but I don’t think there’s any danger of that. Fed independence has pretty broad support across both political parties and in both sides of the Hill.”

Trump has unleashed a rash of tariffs that have put the U.S. economy and the Fed in an increasingly perilous spot. On April 2, the president rolled out aggressive tariff hikes based off U.S. trade deficits with other nations, causing a financial market backlash that almost immediately led him to announce a 90-day pause in which most countries would be charged a baseline 10% tariff while negotiations go forward. But Trump increased his tariff hikes on China to a rate of 145%, in addition to his existing tariffs on Canada, Mexico, autos and steel and aluminum.

Wall Street banks such as Goldman Sachs have raised their odds that a recession could start. Consumers are increasingly pessimistic in surveys about their job prospects and fearful that inflation will shoot up as the cost of the import taxes get passed along to them. The risk of stagflation — stagnant growth and high inflation — would make it harder for the Fed to respond with the same playbook as recent downturns.

The Budget Lab at Yale University estimated that the increased inflationary pressures from the tariffs would be equal to the loss of $4,900 in an average U.S. household.

(AP)

One Response

He can hint at firing the chair but the fact is he can’t. He can appoint someone new when this chairs term expired. More hot air.