Markets around the world continue to sink on fears about President Donald Trump’s protectionist trade policies, and investors keep plowing money into gold, with futures hitting another record high Monday.

Trump’s latest round of tariffs roll out Wednesday, which Trump has been calling “Liberation Day.”

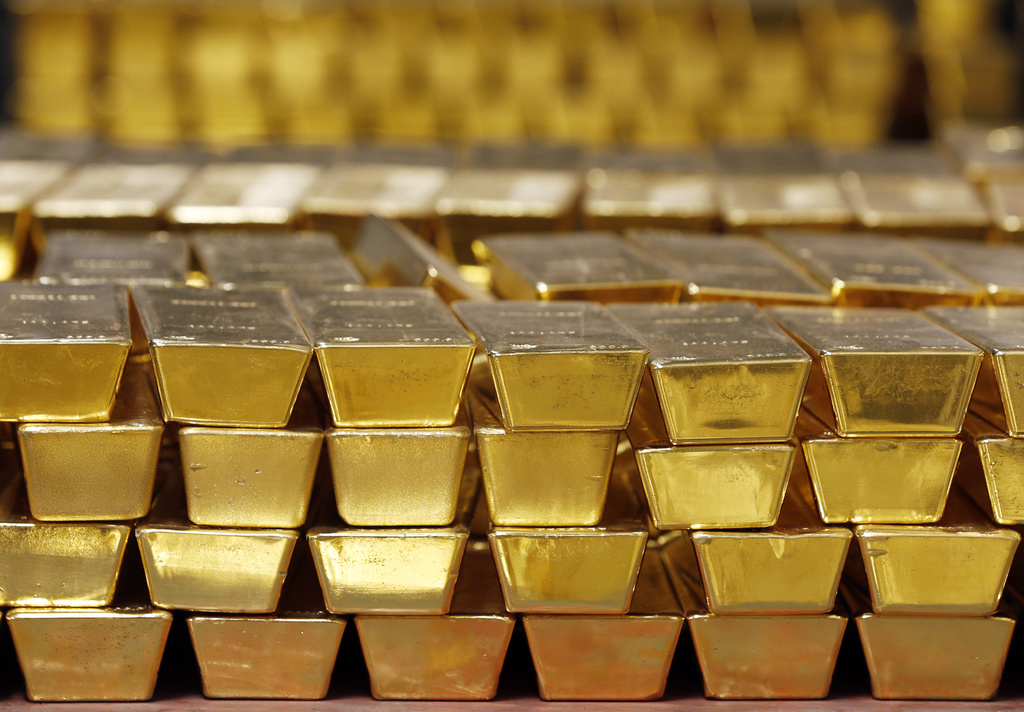

Interest in buying gold can rise sharply in times of uncertainty, as anxious investors seek safe havens for their money. Gold prices have been spiking as Trump’s tariff policies have started an international trade war that’s roiled financial markets and threatened to reignite inflation for families and businesses alike.

If trends continue, analysts say gold’s price could continue to climb in the months ahead. But precious metals are also volatile assets — so the future is never promised.

Here’s what to know.

What’s the price of gold today?

On Monday, the going price for New York spot gold hit a record $3,122.80 per troy ounce — the standard for measuring precious metals, which is equivalent to 31 grams. That’s about $886, or 40%, higher than a year ago.

The price of spot gold is up 19% since the start of 2025, per the data firm FactSet. By contrast, the stock market has tumbled. The benchmark S&P 500 is down 4.5% this year as even blue chip stocks have faded.

Gold futures also reached a record in trading Monday, hitting close to $3,157.40 an ounce.

Why is the price of gold going up?

A lot of it boils down to uncertainty. Interest in buying gold typically spikes when investors become anxious — and there’s been a lot of economic turmoil in recent months.

The heaviest uncertainty lies with Trump’s escalating trade war. The president’s on-again, off-again new levy announcements and retaliatory tariffs from some of the nation’s closest traditional allies have created a sense of whiplash for both businesses and consumers — who economists say will foot the bill through higher prices.

Confidence began to slide at the start of the year for both U.S. households and businesses due to fears of inflation and tariffs. Those worries seem to only be worsening, as U.S. consumer confidence has been eroding for several months

Over the last year, analysts have also pointed to strong gold demand from central banks around the world amid geopolitical tension, including wars in Gaza and Ukraine.

Is gold worth the investment?

Advocates of investing in gold call it a “safe haven” — arguing the commodity can serve to diversify and balance your investment portfolio, as well as mitigate possible risks down the road. Some also take comfort in buying something tangible that has the potential to increase in value over time.

Still, experts caution against putting all your eggs in one basket. And not everyone agrees gold is a good investment. Critics say gold isn’t always the inflation hedge many say it is — and that there are more efficient ways to protect against potential loss of capital, such as derivative-based investments.

The Commodity Futures Trade Commission has also previously warned people to be wary of investing in gold. Precious metals can be highly volatile, the commission said, and prices rise as demand goes up — meaning “when economic anxiety or instability is high, the people who typically profit from precious metals are the sellers.”

If you do choose to invest in gold, the commission adds, it’s important to educate yourself on safe trading practices and be cautious of potential scams and counterfeits on the market.

(AP)