Selfie ID verification has become a key component in digital identity verification, enabling businesses to authenticate users remotely. While the technology offers convenience and accessibility, its effectiveness and security remain under scrutiny. With increasing concerns over identity fraud and data breaches, understanding how selfie verification works and its role in regulatory compliance is crucial. This article explores the fundamentals of selfie ID verification, its process, and its significance in AML and KYC compliance.

What is Selfie ID Verification?

Selfie ID verification is a biometric authentication method where a user takes a photo or video of themselves to confirm their identity. This verification method is widely used in customer onboarding and authentication processes across various industries, including banking, telecommunications, and online services.

To enhance security, selfie verification is often combined with additional identity verification methods such as document verification and liveness detection. Many regulatory bodies worldwide recognize this technology, establishing guidelines for its proper use.

Selfie Verification Process

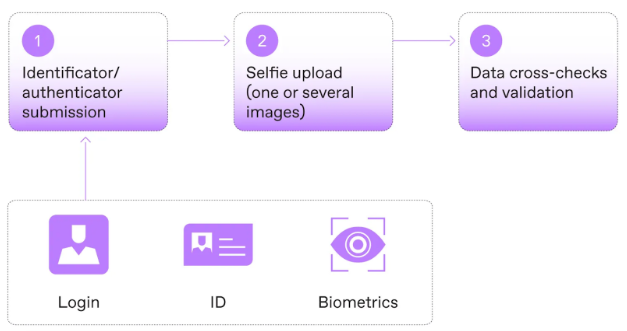

The selfie verification process consists of three key stages:

-

Selfie Capture – The user takes a selfie (one or multiple images) or records a video following specific prompts, such as moving their head or smiling, to prove they are physically present.

-

Selfie Analysis – The captured image is compared to a reference image from a trusted database or an ID document. If a match is found, the user is verified.

-

Liveness Detection (Optional but Recommended) – This step ensures that the image is of a real person and not a spoofing attempt using deepfakes, masks, or printed photos. Liveness detection can be active (requiring specific actions like blinking) or passive (analyzing the image for signs of tampering).

For successful verification, users should be guided to capture high-quality images. Advanced image capture technologies can help ensure proper lighting, positioning, and resolution, improving accuracy and reducing verification failures.

The Importance of Selfie Verification for AML and KYC Compliance

Selfie ID verification plays a crucial role in regulatory compliance, particularly in Anti-Money Laundering (AML) and Know Your Customer (KYC) processes. Financial institutions and online platforms are required to verify users’ identities to prevent fraud, money laundering, and identity theft.

However, selfie verification alone is often not sufficient for high-security scenarios. Regulatory frameworks such as eIDAS in the EU and the NIST guidelines in the US outline varying levels of identity verification:

-

Low security level – Selfie verification alone, without linking to official documents.

-

Medium security level – Selfie verification combined with government-issued ID verification.

-

High security level – Additional proof of identity, such as utility bills, bank statements, or in-person verification.

While selfie verification is accepted in some jurisdictions as part of KYC requirements, other regions mandate stronger verification methods to meet compliance standards.

Incorporating Selfie Verification into Your Processes

Businesses looking to integrate selfie verification into their identity verification workflows should consider the following:

-

Customer Onboarding – Digital businesses such as telecom providers, ride-sharing platforms, and online services can use selfie verification to streamline user registration.

-

Check-in Security – Airlines, hotels, and rental services can leverage selfie checks to verify users during self-check-in processes.

-

Transaction Verification – Banks and fintech platforms can use selfie authentication to approve high-risk transactions.

-

Multi-Factor Authentication – Digital platforms, including e-learning and e-commerce sites, can use selfie verification as an additional authentication layer for returning users.

For seamless implementation, businesses should adopt a robust face verification SDK that supports liveness detection and secure data transmission. Regula’s Face SDK provides a customizable solution that ensures high accuracy and security while accommodating diverse user demographics.

Conclusion

Selfie ID verification is a powerful tool for remote identity authentication, offering convenience, accessibility, and enhanced security when combined with proper verification measures. However, its effectiveness depends on implementing liveness detection, document verification, and compliance with regulatory standards.

While selfie verification alone may not always meet stringent AML and KYC requirements, integrating it with other verification methods strengthens identity security and prevents fraud. By leveraging advanced verification technologies like Regula’s Face SDK, businesses can ensure a secure and seamless user experience while maintaining compliance with global regulations.