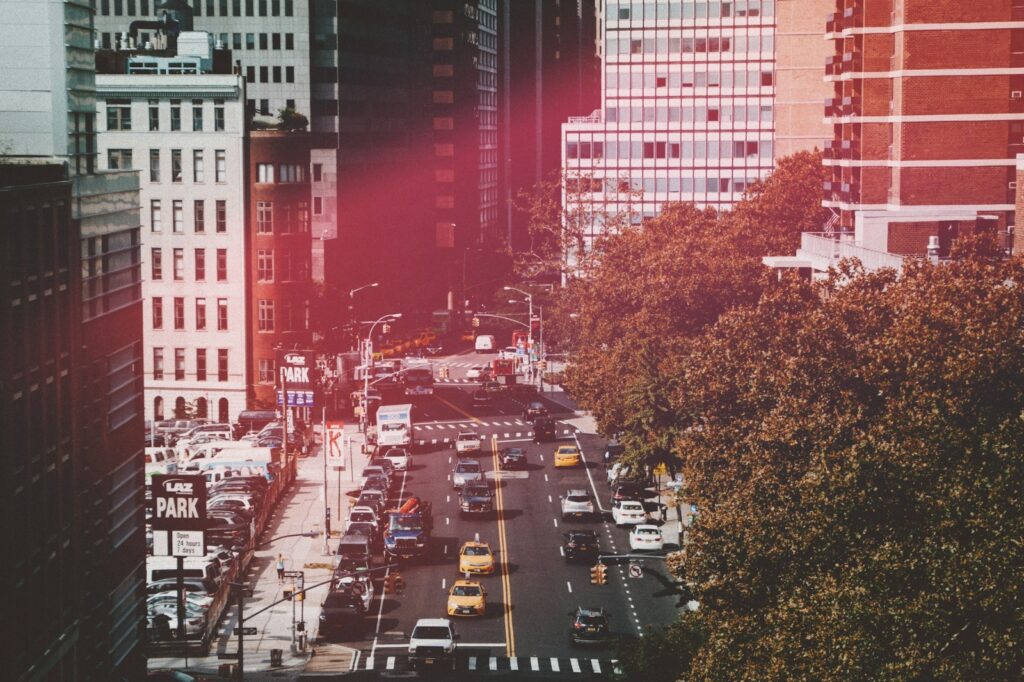

Navigating the New York housing market is like walking through a maze. It’s complicated, often overwhelming, and constantly changing. Among the many factors influencing this market, interest rates play a crucial role. For the Jewish community in New York, understanding how these rates impact housing choices can make a significant difference in home buying experiences.

Understanding Interest Rates

Let’s break it down. Interest rates are basically the cost of borrowing money. When you take out a mortgage, you’re paying back that loan plus interest. There are fixed rates, which stay the same throughout the loan term, and variable rates, which can change based on market conditions. Right now, interest rates are on the rise. This shift is affecting not just the economy but also how people, especially in the Jewish community, approach home buying.

The Federal Reserve has been adjusting rates to manage inflation, which means if you’re looking to buy a home, now’s the time to pay attention. Due to changing dynamics many potential buyers are choosing to apply for a mortgage loan online to ensure they are up to date.

The Jewish Community in New York

Now, let’s talk about the Jewish community in New York. It’s diverse and vibrant, with a mix of traditions and lifestyles. From young families looking for their first home to retirees downsizing, everyone has unique needs. Many prefer homes close to synagogues, kosher markets, and Jewish schools. This geographical preference shapes their housing choices.

When interest rates rise, it’s not just a number on a chart; it’s a real concern for many. Homeownership is often viewed as a key to stability and community ties. However, with increasing costs, families might find themselves facing tough decisions.

The Direct Impact of Interest Rates on Housing Choices

So, how do rising interest rates directly affect housing choices? For starters, let’s talk about affordability. When rates go up, so do monthly mortgage payments. This can push potential buyers out of the market or force them to reconsider their options. Many find themselves looking at smaller homes or different neighborhoods altogether.

Buyer behavior is changing too. Some are shifting from buying to renting because owning a home is becoming less feasible. Others may delay their purchases, hoping for a drop in rates. It’s a tough spot to be in, especially when you’re ready to settle down and create a home.

The market itself feels the pressure. As fewer buyers enter the fray, property values can fluctuate. In some cases, homes may stay on the market longer, leading to more competitive pricing. For those who are still in the market, this can be a double-edged sword. It’s great to find a home that fits your budget, but the uncertainty can make the process feel daunting.

Community Responses to Interest Rate Changes

What’s the community doing in response to these challenges? Many are getting proactive. First-time homebuyers are seeking financial advice, learning how to budget effectively, and exploring various financing options. Some are even teaming up with family or friends to purchase homes together, making it more affordable.

Community organizations are stepping up too, offering resources and education on navigating the housing market. They’re providing valuable insights into the buying process, helping families understand their options and encouraging them to take that leap into homeownership.

Conclusion

The impact of interest rates on housing choices in the Jewish community is profound. It shapes not only financial decisions but also the very fabric of community life. As interest rates continue to rise, it’s essential to stay informed and connected. The more knowledge you have, the better equipped you are to make choices that fit your family’s needs. In this ever-evolving market, being proactive can help ensure that you find not just a house, but a home.