For instance, the euro’s recent decline below the $1.08 level, a response to the escalating tension, highlights how geopolitical strife can impact major currency values. This movement in the euro, touching its lowest point since mid-November, has been further influenced by the European Central Bank’s (ECB) changing monetary stance, as indicated by Isabel Schnabel’s comments suggesting an accelerated timeline for potential rate cuts.

The ECB’s recent Consumer Price Index report, revealing a drop in the Euro Area’s inflation rate to 2.4%, highlights a shifting economic landscape, intensified by Francois Villeroy de Galhau’s comments on rapid disinflation. This scenario, demanding agility from forex traders, underscores the impact of geopolitical events on market dynamics, affecting not only major pairs like EUR/USD but also minor and exotic currencies.

With the backdrop of the Israel-Hamas conflict, forex traders must remain vigilant to the potential impacts on currency values, mindful of the fact that geopolitical tensions can lead to unpredictable market movements and opportunities. The situation calls for a keen understanding of how such conflicts can reverberate through global financial markets, potentially setting the stage for significant shifts in forex trading dynamics in the coming year.

The Evolution of Forex/CFD Trading Platforms

The landscape of Forex and CFD trading has undergone a remarkable transformation over the last decade. In the late 1990s, the advent of trading platforms like MetaTrader revolutionized retail trading. These platforms, especially MetaTrader 4 (MT4) and its successor, MetaTrader 5 (MT5), have evolved from basic trading terminals to sophisticated, multifunctional tools.

They now offer diverse trading instruments, from traditional Forex pairs and CFDs to evolving cryptocurrencies like BTC, ETH, and XRP. Notably, MT4 remains a popular choice, celebrated for its mobility, security, and multifunctionality. For traders, it is imperative to download and install a powerful forex trading app to deal with the challenges of dynamic markets. The MT4 platform is pivotal in providing retail access to global financial markets, a testament to the dynamic nature of modern trading.

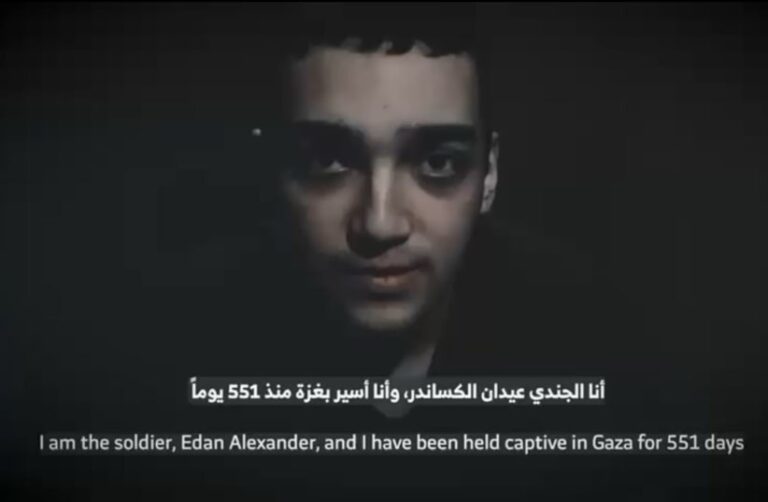

Impact of the Israel-Hamas Conflict on Regional and Global Markets

The ongoing conflict between Israel and Hamas, beyond its immediate and tragic human cost, is casting a long shadow over the economic landscape of the Middle East and North Africa. As the region braces for the repercussions of this conflict, its economic outlook, already dampened by pre-existing conditions, faces further challenges.

In 2022, the Middle East and North Africa region enjoyed robust economic growth of 5.6 percent. However, the forecast for 2023 tells a different story, with growth expected to decelerate to just 2 percent. This economic slowdown, while not entirely due to the Israel-Hamas conflict, is significantly worsened by it.

The conflict’s length, severity, and reach are key in determining its overall economic impact. A prolonged, intense conflict poses a substantial risk to the region’s economy, highlighting the critical need for international containment and de-escalation efforts.

The conflict’s economic effects are felt most sharply in Israel, the West Bank, and Gaza, but they also ripple out to neighboring countries like Egypt, Jordan, and Lebanon. These nations are particularly suffering in sectors like tourism, a major economic driver. For instance, Lebanon has seen a drastic 45 percentage point drop in hotel occupancy since last year.

This downturn in tourism, which previously contributed significantly to regional economies, threatens long-term economic damage. As the conflict persists, it becomes increasingly vital to implement policies that safeguard these economies against such disruptions and maintain regional stability.

The Israel-Hamas conflict also sent ripples through the global markets, initially perceived as a localized event but gradually recognized for its potential global economic repercussions. The conflict’s escalation has heightened investor unease, contributing to a volatile economic environment. This uncertainty has been particularly evident in the forex markets, where currency pairs have experienced significant fluctuations in response to the conflict’s developments.

Currently, the USD/ILS currency pair exhibits dynamic trading activity amid the ongoing conflict between Israel and Hamas and fluctuating economic conditions. The pair was trading near 3.70300, following a dip to approximately 3.69230. Notably, on November 29th, it briefly fell below 3.67000 before surging to 3.75725 later in the week.

This week’s trading pattern has shown a general downward trend with occasional upward reversals. The market’s reaction reflects both the impact of the conflict and domestic factors in Israel, with the USD/ILS pair adjusting to these multifaceted influences. Technical traders are closely watching the range between 3.69000 and 3.75000, which has remained relatively consistent since November 16th.

While short-term fluctuations are expected, especially around key events like U.S. job numbers and Federal Reserve statements, the overall trend and trading strategy for the USD/ILS pair continues to be shaped by these ongoing developments.

Table: Comparative Analysis of Market Indicators

|

Indicator |

Pre-Conflict Value September |

Post-Conflict Value November |

|---|---|---|

|

EUR/USD Exchange Rate |

$1.10 (approx.) |

$1.08 |

|

$89/$93 per barrel (approx.) |

$77/$82 per barrel (varied) |

|

|

Israeli Shekel (NIS/USD) |

NIS 3.80/$ |

NIS 3.70/$ |

|

Foreign Exchange Reserves (Israel) |

$191.235 billion |

$198.169 billion |

Euro’s Decline: The Euro fell below $1.08, the lowest since mid-November, due to the ECB’s dovish outlook.

-

Regional Economic Impacts: Tourism in countries like Lebanon was severely hit, with hotel occupancy rates falling by 45 percentage points in October compared to a year ago.

-

Impact of Israel-Hamas Conflict on Markets: Initially, there was limited impact, but escalating conflict increased market unease, affecting investor behavior and forex market dynamics.

-

Oil Market Volatility: Crude prices surged but then dipped, reflecting changing global demand conditions.

-

Bank of Israel’s Response: Sold $8.2 billion in foreign currency in October; foreign exchange reserves increased by $6.934 billion in November.

-

Israeli Shekel’s Movement: Despite limited foreign currency sales, the shekel strengthened by 9% in November, trading around NIS 3.70/$ currently.

Conclusion

In conclusion, the Israel-Hamas conflict underscores the intricate interplay between geopolitical events and Forex markets. As the situation evolves, its impact on global trading, particularly on currency pairs, serves as a potent reminder of the need for adaptability and vigilance in the complex world of Forex trading. Traders must remain alert to the shifting economic landscapes, understanding that such conflicts can significantly influence market dynamics and trading strategies.