The Federal Reserve is on track to raise its benchmark interest rate for the 10th time on Wednesday, the latest step in its yearlong effort to curb inflation with the fastest pace of hikes in four decades.

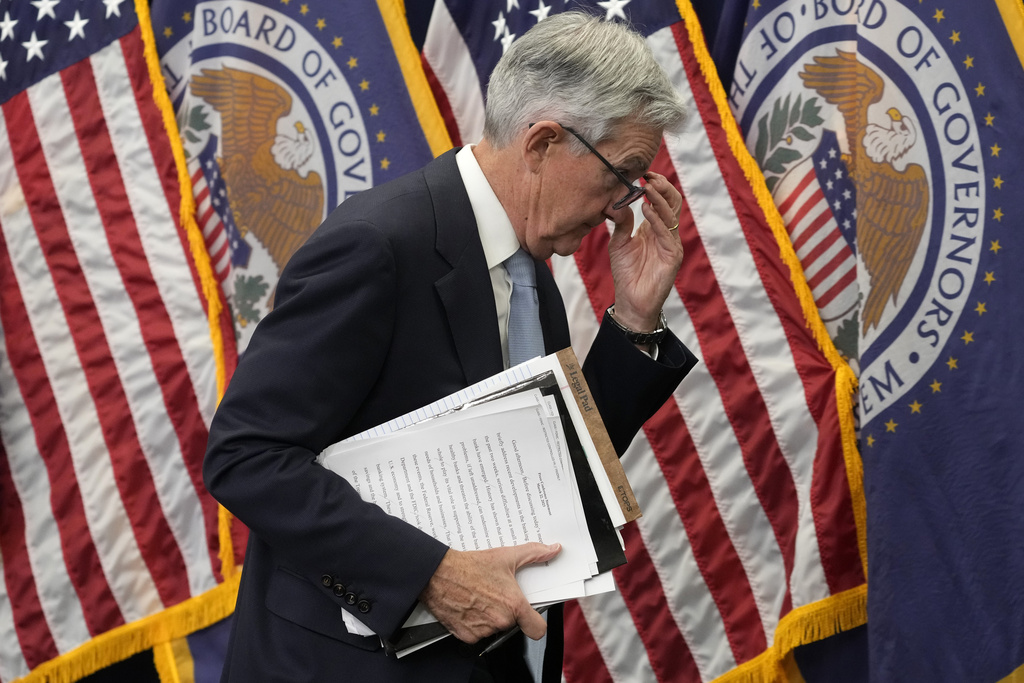

Yet economists and Wall Street traders will be more interested in what the Fed and Chair Jerome Powell signal in a statement and at a news conference about a bigger question: What comes next? And on that note, they may be disappointed.

Economists say Powell will likely hint that the Fed is edging closer to a long-awaited pause in its rate increases. Yet he won’t necessarily send a clear sign that this week’s hike will be the Fed’s last. Instead, he will probably stress that further rate hikes could happen if inflation were to stay persistently high, well above the Fed’s 2% target rate.

“He wants to kind of tell the market, ‘Don’t relax. Don’t be complacent. We could still hike more if we think we need to, but we don’t know if we have to yet,’ ” said Derek Tang, an economist at LHMeyer, an economic consulting firm.

The weekend collapse of First Republic Bank, the second-largest bank failure on record, isn’t expected to stop the Fed from proceeding with a rate hike Wednesday. First Republic, the third major bank to fail in the past two months, was seized by regulators on Sunday night and was sold to JPMorgan Chase.

Even if Powell strongly suggests that the Fed will pause its hikes after this week, Tang said, he will likely emphasize that the Fed doesn’t expect to cut rates anytime this year. Even so, investors are predicting two Fed rate cuts by year’s end, according to CME’s Fedwatch tool.

Another quarter-point rate increase on Wednesday would leave the Fed’s key rate at 5.1% — a 16-year high and a full 5 percentage points higher than in March 2022.

“He could very credibly say, ‘It makes sense for us to take a breather here, and we’re not lowering them, so the rates are still really high,’ ” Tang added.

At the Fed’s last meeting, in March, its officials forecast that they would implement one more hike and then leave rates unchanged until next year. Those forecasts are issued once each quarter, so they won’t be updated until June.

Seven of the Fed’s 18 policymakers, though, projected that rates would exceed 5.1%, while only one policymaker forecast a lower rate. That suggested that the Fed as a whole was leaning toward additional hikes.

The central bank has been rapidly tightening credit to combat inflation, which reached its highest level in four decades last summer and has been slowing gradually since then. The rate increases are intended to slow borrowing and spending to cool the economy.

But in the process, the Fed’s rate hikes have led to higher costs for many loans, from mortgages and auto purchases to credit cards and corporate borrowing, and have heightened the risk of a recession.

The next steps for the central bank, after this week, are clouded by uncertainty and a mix of conflicting signals. The economy appears to be cooling, with consumer spending flat in February and March, indicating that many shoppers have grown cautious in the face of higher prices and borrowing costs.

The surprisingly resilient job market, which has kept the unemployment rate near 50-year lows for months, is showing some cracks. Hiring has decelerated, job postings have declined and fewer people are quitting their jobs for other, typically higher-paying positions.

Compounding the uncertainties the Fed faces is the impact of the large bank failures of the past two months. Analysts don’t expect more banks to collapse. But many of them could tighten lending, which would slow the economy.

“For every First Republic or Silicon Valley Bank, there will be hundreds of smaller and mid-sized U.S. banks that will act more conservatively in the months ahead in order to minimize any risk that they end up in the same situation,” Krishna Guha, said an analyst at Evercore ISI, an investment bank.

To some degree, that is what the Fed wants because less borrowing and spending would likely help ease inflation.

Evidence of a sharp pullback in lending might even make Powell more comfortable about hinting that this week’s rate hike might be followed by a pause. At the Fed’s meeting in March, Powell had said that if banks restricted lending, it could act as the equivalent of an additional quarter-point rate hike.

Fed officials will have information from a survey of bank loan officers when they meet this week, though the results won’t be made public until next week.

Most crucially, the policymakers must decide where they think inflation is likely headed. Some major drivers of higher prices, such as rents, energy, and used cars, have puttered out or started to reverse, causing sharp drops in overall inflation. The consumer price index rose 5% in March from a year earlier, sharply lower than its 9.1% peak in June.

The growth in rental costs has started to decline as more newly built apartments have come online. Gas and energy prices have fallen steadily. Food costs are moderating. Supply chain snarls are no longer blocking trade, thereby lowering the cost for new and used cars, furniture and appliances.

As hiring and job openings decline, wage growth should also slow, some economists argue. The Fed, they say, should look less at backward-looking data such as the unemployment rate and more at where such trends appear headed.

“If you’re ignoring that, and you’re still raising rates regardless, then you’re going to find yourself very soon running the risk of overdoing it, substantially overdoing it,” said Ian Shepherdson, chief economist at Pantheon Macroeconomics. “I really think that we’re now into mistake territory.”

But Fed officials are now gun-shy about shifting their policies based on trends that could lower inflation in the future, such as cheaper rents. Powell and other officials have said they want to see inflation decline consistently before considering major policy shifts on interest rates.

And data released Friday showed that inflation and wage growth remained stubbornly high in March. Excluding the volatile food and energy categories, “core” prices in the Fed’s preferred inflation index rose 4.6% from a year ago, scarcely better than the 4.7% it reached in July.

Christopher Waller, a member of the Fed’s Board of Governors, cited similar figures from the consumer price index earlier last month in saying, “I interpret these data as indicating that we haven’t made much progress on our inflation goal.”

(AP)