If confirmed as IRS commissioner, Daniel Werfel says he will commit to not increasing tax audits on businesses and households making less than $400,000 per year.

Anticipating questions ahead of his confirmation hearing Wednesday before the Senate Finance Committee, Werfel in prepared testimony makes several other commitments aimed at revamping the beleaguered agency.

President Joe Biden nominated Werfel to steer the Internal Revenue Service as it receives a massive funding boost — nearly $80 billion over the next 10 years through the Inflation Reduction Act, which Congress passed in August. Noting the act’s impact on the federal tax collector, Werfel says that “Americans rightfully expect a more modern and high-performing IRS.”

While promising to modernize the agency’s technology, address its paperwork burden and audit high-income earners, Werfel says he will be “unyielding in following my true north to increase public trust.”

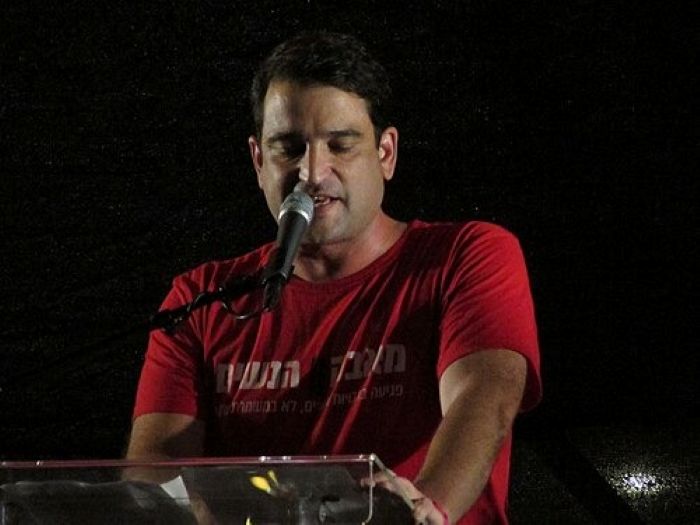

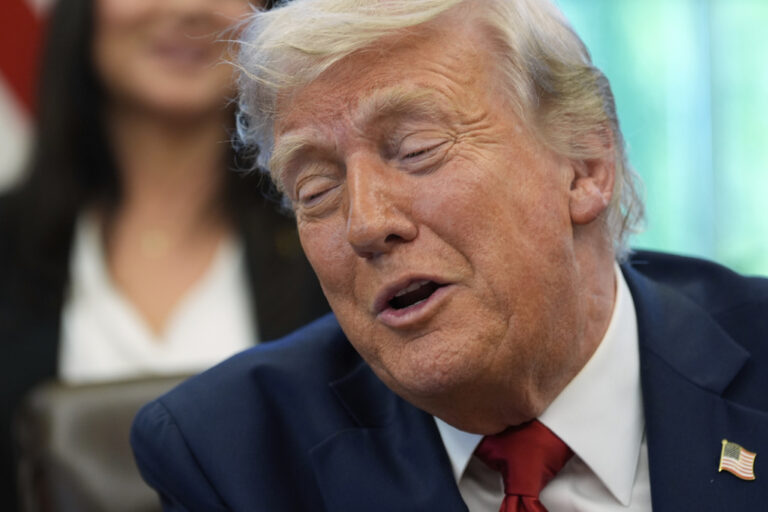

Werfel, 51, who led Boston Consulting Group’s global public sector practice, was nominated to replace Charles Rettig. Selected by President Donald Trump to lead the agency, Rettig left when his five-year term ended in November. An acting commissioner has been filling in.

Werfel will also have to navigate controversy surrounding the new funding, brought by critics who have distorted how the new law would affect the IRS and taxes for the middle class. About $46 billion was allocated for enforcing tax laws and the rest to taxpayer services, operations support and updating business systems.

Republicans have suggested without evidence that the agency would use the new money to hire an army of tax agents with weapons.

Disapproval of the agency reached new heights when House Republicans began their tenure in the majority last month by passing a bill that would rescind the funding, fulfilling a campaign promise. The legislation has not advanced in the Senate and is unlikely to reach Biden, who has promised a veto.

“The hearing promises to be a doozy, and not only because the IRS is one of the most unpopular government agencies in the United States,” said Janet Holtzblatt, a senior fellow at the Urban-Brookings Tax Policy Center. “This will be the first big IRS hearing since it received an $80 billion boost to its budget in the Inflation Reduction Act.”

GOP criticism appeared more directed at Biden administration efforts to bolster funding for the agency than at Werfel himself. But tax experts say Werfel should expect to face a slew of managerial questions.

Caroline Bruckner, a tax professor at the American University Kogod School of Business, said that, if confirmed, Werfel would have to address the massive workforce challenges at the IRS wrought by attrition, an aging workforce and a generally poor reputation.

“The next generation of accountants don’t want to work for the IRS,” Bruckner said. She added, “To attract the best talent, particularly with Millennials and Gen-Z workers who will be the future of the workforce, transparency as a leader will go a long way.”

Bruckner referred to a Stanford University study that showed IRS data-driven algorithms chose Black taxpayers to audit up to 4.7 times the rate of non-Black taxpayers. “The next generation of workers care about these things, and this is a leadership challenge,” she said.

Robert J. Kovacev, a federal tax attorney at Miller & Chevalier in Washington, said Werfel will have to explain how the agency could best spend its new funding.

“I think that $80 billion gives the IRS some choices on how to improve that they didn’t have before,” he said. “They could spend it on new revenue agents, or new technology investments to make it fairer and more efficient.”

(AP)

3 Responses

Unfortunately, the $400K threshold doesn’t really provide a lot of comfort since many families with both parents in professional careers will quickly be over $400K. Most of the big New York new york law firms and investment banks have pushed their starting salaries close to $200K. The threshold should be indexed to inflation and COL variations.

You dont need 87,000 irs agents to selectively review all people making 400k.

This is such a lie.

“This is such a lie”

Cheskib: The only “lie” is your deliberate misstatement with respect to the “87,000 agents” unless you are simply ignorant of the FACTS readily available on the Treasury website rather than babbling Republican talking points. The 87,000 figure comes from a 2021 Treasury report with respect to the number of employees that might be needed over the NEXT TEN YEARS to replace approximately 55,000 expected retirements and the new responsibilities assigned to the IRS by Congress in recent legislation including the IRA. Fewer than 7,000 of that number will be assigned to enforcement efforts, including audits, again, over the FY 2023-2032 time frame, including replacing existing auditors. The rest will be allocated to computer modernization (aka moving beyond Fortran and Cobal) and mundane “customer assistance” with the largest number assigned to significantly increase the personnel assigned to taxpayer assistance (both telephone and in-office).

We can argue about the absurd complexity of our tax code but please control yourself when you spout such nareshkeit.