The Trump administration has directed the U.S. federal employee retirement fund to scrap its plan to place more than $4 billion into Chinese investments, a move that comes as the president blames Beijing almost daily for not doing more to stop COVID-19 from spreading around the world.

The administration has given the board overseeing the Thrift Savings Plan until Wednesday to comply with the president’s directive. TSP is a tax-deferred retirement savings and investment plan that works like a 401(k) plan offered by private corporations.

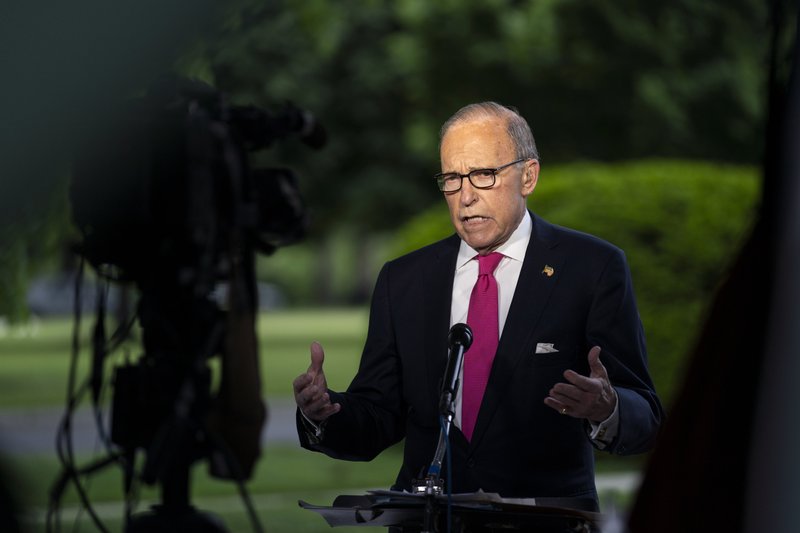

National Economic Council Chairman Larry Kudlow and the president’s national security adviser Robert O’Brien wrote a letter Monday to Labor Secretary Eugene Scalia calling on the retirement fund’s board to keep money out of Chinese equities. Fox Business Network first reported the development.

The letter warned that such investments present significant national security and humanitarian concerns because they operate in violation of U.S. sanction law and help China bolster its military and oppress religious minorities living in the country.

“The Federal Retirement Thrift Investment Board … is set to implement these plans during a time of mounting uncertainty concerning China’s relations with the rest of the world, including the possibility that future sanctions will result from the culpable actions of the Chinese government with respect to the global spread of the COVID-19 pandemic,” the letter said.

Scalia followed with a letter to the Federal Retirement Thrift Investment Board asking it to forgo its plan to move money into the Chinese equities.

In November 2017, the board selected a new benchmark index for investing a portion of its funds to one that contains equities from emerging markets, including China. The board evaluated that decision last year after a group of senators expressed concern that companies benefiting from this investment would “include those involved in military activity, espionage and human rights abuses by the Chinese government,” Scalia wrote.

The board declined to reverse its decision and the fund is expected to shortly invest up to $4.5 billion in Chinese equities. Scalia noted in his letter to the board that its members serve on expiring terms and that Trump last week nominated three replacements to the board.

(AP)

2 Responses

Actually he said that the TSP should not switch it’s “I” (International) fund from one that tracks the index of developed countries, to a different index fund that tracks all countries including emerging markets, including China. These are commercial index funds from a major vendor available to any investor. Since a lot of Americans are getting fed up with China for a variety of reasons (not just Republicans), I suspect the vendors of index funds will start coming up with ones that exclude China, e.g. all emerging markets other than China, just as they routinely offer the option to buy a fund that includes all developed countries excluding the United States.

The primary rule for investing retirement funds is to focus on what’s best for the current and future retirees. If China poses serious threats to the present and future retirees, by its negligence or malfeasance about coronavirus, or any other issues, that would be an appropriate consideration. I (and many other smart people) doubt Trump’s allegations about Chinese responsibility for the coronavirus pandemic. Applying Trump’s proposal, and considering his administration’s negligence and malfeasance in controlling the coronavirus in the US, that would put US bonds and notes off limits to federal retiree investment funds.