If your employer is sticking you with a bigger share of the medical bill before health insurance kicks in, you may have to get used to it.

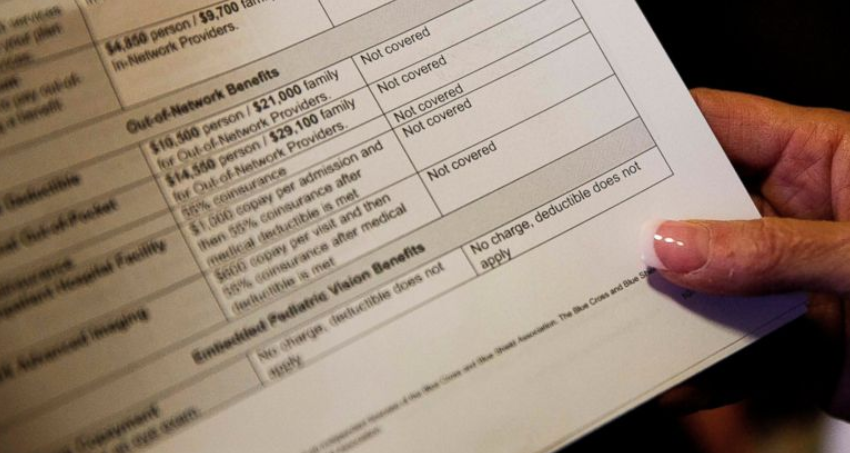

More companies are making workers pay an annual deductible or increasing the amount they must spend before insurance starts covering most care, according to a survey released Wednesday by the Kaiser Family Foundation. Annual deductibles for single coverage have now climbed about eight times as fast as wages over the last decade.

That means that those who use the health care system are pouring more of their take-home pay into medical bills even though they have coverage.

Health benefits experts say they see few signs that these rising deductibles will level off anytime soon for employer-sponsored benefits.

“At some point they have to come down to Earth, we just don’t know what point that is,” said Matthew Rae, a Kaiser senior health policy analyst.

Employer-sponsored coverage is the most common form of health insurance in the United States, covering about 152 million people, according to Kaiser.

The nonprofit found that the annual cost or premium for family coverage rose 5 percent this year to $19,616, on average, while single coverage premiums climbed 3 percent to $6,896. That continued a trend toward moderate increases over the past several years.

Employers pick up most of those costs, but they also have been asking workers and their family members to pay more for care before that coverage starts.

A total of 85 percent of workers with single coverage have a general deductible, up from 81 percent last year and 59 percent in 2008. That doesn’t count separate deductibles for things like prescription drugs.

The average deductible for single coverage climbed slightly this year to $1,573 compared to $1,505 last year. But that amount has more than doubled since 2008.

Deductibles for family coverage are more complex and harder to track, but Kaiser has seen steady growth in them as well.

Employers continue to raise deductibles on their health plans in part because they encourage those who use care to consider prices or even rethink whether they need the care since they are paying more of the upfront cost, said Paul Fronstin, an economist with the nonprofit Employee Benefit Research Institute.

He said it is also simpler for companies to increase deductibles instead of making more complex changes like adjusting the network of care providers covered under their plan to save money.

Kaiser also said that deductibles are growing partially because some employers soften that upfront cost by giving their workers tax-advantaged savings accounts to help pay the medical expenses.

While deductibles for employer-sponsored coverage are rising, they are still several thousand dollars smaller than deductibles seen in the Affordable Care Act’s marketplaces for people who don’t get insurance through work.

(AP)