Democratic-leaning Illinois is the latest state to direct taxpayer money to private schools, a development that’s caught some by surprise and brought condemnation from politically powerful teacher unions and Democrats looking to defeat the Republican governor in 2018.

Gov. Bruce Rauner and the Democratic-controlled Legislature last week approved a sweeping overhaul of the way Illinois funds schools. It included a new $75 million tax credit for people and companies that donated to private school scholarships.

“It’s an important way for lower income parents to have choices that higher income parents already enjoy because of the financial circumstances that they are blessed with,” said Rauner, a multimillionaire and longtime advocate for school choice.

The program allows people and companies to get a credit worth 75 percent of their donation, up to $1 million. Lawmakers say it will provide scholarships for 6,000 to 10,000 students statewide to attend private schools, where teachers and other staff typically aren’t unionized. The students must come from households with an annual income below 300 percent of the federal poverty level, or about $73,000 for a family of four.

Unions argue it will take money from public education to benefit the governor’s wealthy friends. The credit “is tantamount to planting a ticking time bomb on a bus and driving through school districts throughout the state, creating even greater debt and fiscal distress,” the Chicago Teachers Union said.

Many of the more than half-dozen Democrats running for governor have vowed to try to eliminate the tax credit, if elected.

“Our governor shouldn’t advocate for robbing public education to enrich private schools,” said Chris Kennedy, a businessman and nephew of the late President John F. Kennedy.

Nearly 20 states have tax credit scholarship programs, according to the National Conference of State Legislatures. Most are Republican-led states, including Florida, Arizona and Indiana. But efforts to approve them are often difficult.

Idaho legislators have tried several times. South Carolina’s has to be reauthorized each year as part of its state budget.

In Illinois, the tax credit that became law on Thursday didn’t surface publicly until Monday, when it was introduced in a roughly 550-page bill negotiated behind closed doors. The state House approved it within hours, and the state Senate did so the next day.

Both Democrats and Republicans said the credit was a GOP idea that was critical to passing compromise legislation to get money to schools. Its sudden appearance baffled advocates who’ve been pushing for years to change Illinois’ funding system.

“It sort of popped out of nowhere,” said Superintendent Sharon Desmoulin-Kherat, in central Illinois’ Peoria.

The approach is one of several school choice models, like vouchers and education savings accounts, allowing the use of public money to send children to private school. Approved nonprofit groups can solicit and collect donations — either from businesses or individuals — in exchange for tax credits. The organizations pay the private and parochial schools directly.

Critics say the setup allows for the misuse of funds.

Illinois’ model will be tested out in a five-year pilot program and appears to have been crafted with those concerns, including provisions on transparency and accountability, said Josh Cunningham of the National Conference of State Legislatures, which studies the programs. He said Illinois “regulates the scholarship granting organizations at a level that no other state does.”

Still, public school administrators worry about losing high-performing students while costs for the district, including paying teachers and running facilities, don’t decrease. Peoria, with a population of about 114,000 people, has more than 20 private schools nearby, most of them religiously affiliated.

“I’m not afraid of competition, I just think it’s not fair,” Desmoulin-Kherat said. “When those dollars are being routed to them and they’re getting to pick and choose (students). I don’t get to pick and choose.”

Almost 75 percent of the district’s roughly 14,000 students are poor.

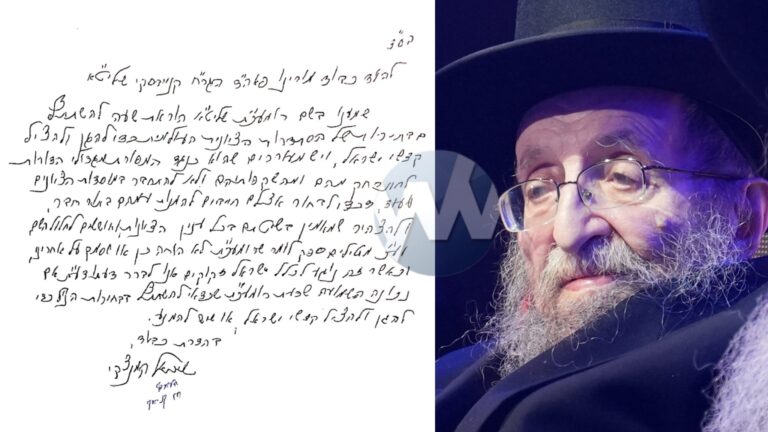

One of the chief backers of the tax credit was Chicago Cardinal Blase Cupich, who said he’s supported the idea for years and spoke with legislative leaders during the negotiations.

The Archdiocese of Chicago would be among the groups that would benefit the most. It runs over 200 elementary and high schools around the Chicago area, serving around 80,000 students. Cupich dismissed the notion that private schools would siphon the best students, saying the Catholic schools in the city are diverse and don’t turn people away.

“The most important decision that a parent makes, with regard to their children, is where their children go to school. There’s a lot of people who don’t have the freedom to make that choice because of their level of income,” he said. “This evens the playing field for all parents and all children to do that.”

(AP)

2 Responses

I cannot see any financial problem with the scholarship, seeting as with or without the scholarship the school funding stays the same. One might wonder if the real reason for the complaint is that the scholarship would siphon off the best and the brightest from the public school system (which indoctrinates the values of the Democrats) to the private schools (which would be more Republican friendly).

NPR reports on the numbers for Illinois. Most states break down school funding as 45% “local” (like property tax), 45% state and 10% federal. Illinois has 56.8% “local” funding, which right away means that poor “locals” have an even greater disadvantage. That can only change if the formula is changed, which has nothing to do with the scholarship.

As a bit of a novice to the various levels of government programs, can anyone comment on the bearing this may or may not have on funding for yeshivos? Both in Illinois and nationally?