The nation’s largest mortgage lender borrowed $11.5 billion from a group of 40 banks to fund new loans, in a move that shows just how deep the lending crisis has become.

Countrywide Financial Corp. said Thursday it made the move amid a credit crunch that has driven a number of its smaller peers to bankruptcy.

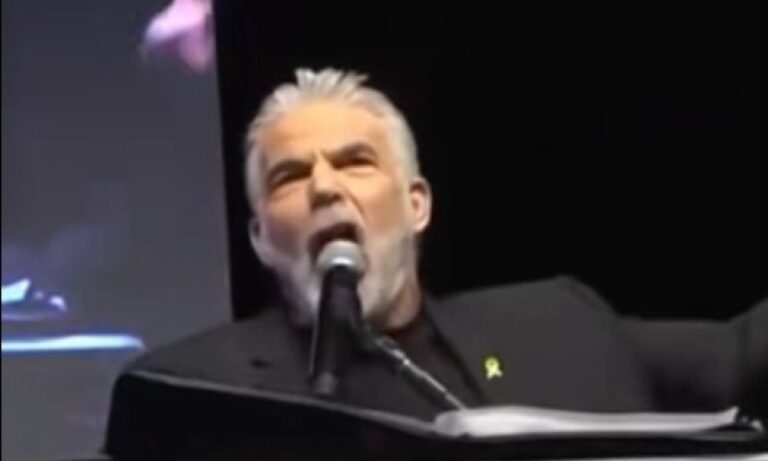

“Countrywide has taken decisive steps which we believe will address the challenges arising in this environment and enable the company to meet its funding needs and continue growing its franchise,” Countrywide President and Chief Operating Officer David Sambol said in a statement.

The credit worries have grown as the secondary market for mortgages all but disappeared in recent weeks. Investors have worried about the value of loans and rising delinquencies and defaults.

Mortgage lenders rely on the secondary markets to borrow money to make more loans. The problems started as subprime mortgages – loans given to customers with poor credit history – started going delinquent and defaulting at faster rates. [MORE]