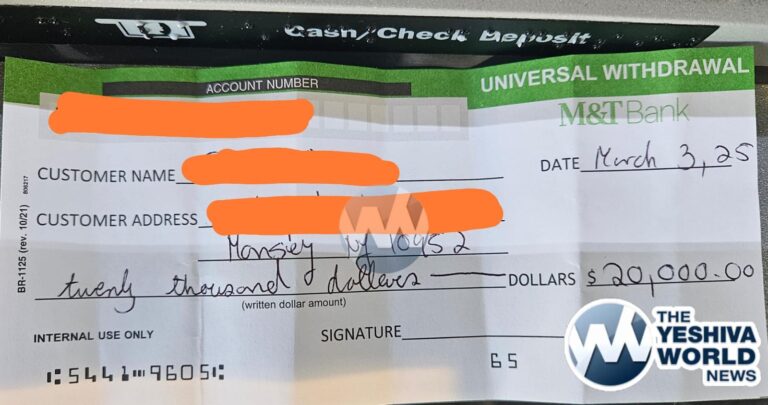

Bank Leumi has recently mailed the attached letter (below) to their U.S. accountholders informing them of their ability to make a voluntary disclosure of their foreign bank accounts to the U.S. Internal Revenue Service, and, in the letter, Leumi specifically endorses the voluntary disclosure approach.

Bank Leumi has recently mailed the attached letter (below) to their U.S. accountholders informing them of their ability to make a voluntary disclosure of their foreign bank accounts to the U.S. Internal Revenue Service, and, in the letter, Leumi specifically endorses the voluntary disclosure approach.

We believe that this letter is the precursor to forwarding the names and account information of Leumi’s US accountholders (including those accountholders that recently closed their accounts) to the U.S. authorities. The letter is intended to provide those accountholders with an opportunity to disclose their accounts to the IRS, in advance of the IRS receiving the information from Leumi. If the IRS receives a U.S. accountholder’s information from Leumi prior to receiving a voluntary disclosure application, the U.S. accountholder would become ineligible from making a voluntary disclosure, and the accountholder would be at serious risk of criminal prosecution.

This certainly should give comfort to U.S. Bank Leumi accountholders who have previously joined the voluntary disclosure program. Those who haven’t, should give serious consideration to joining that program.

Robert S. Fink and the members of Kostelanetz & Fink, LLP have already assisted hundreds of Bank Leumi accountholders with making voluntary disclosures to the Internal Revenue Service.

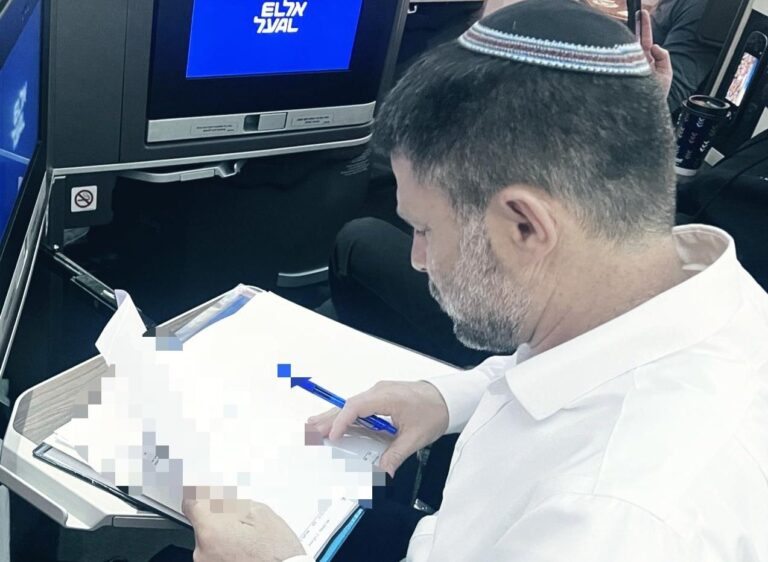

CLICK ON IMAGE TO ENLARGE

Joseph Septimus is a tax and trusts and estate attorney with the law firm of Kostelanetz & Fink, LLP, and can be reached at (212) 808-8100 or [email protected]

(Joseph Septimus – YWN)

2 Responses

YWN Editor,

I feel that it is inappropriate for you to allow an attorney to use this type of forum as a means of advertising his business unless he explicitly discloses that he is willing to discuss the issues to each person for free.

Sincerely,

A Fellow Attorney

my advice would be to wait before self-disclosing… as the bank has not said they’re going to release names…