Home prices hit new post-bubble lows in March, according to a report out Tuesday.

Home prices hit new post-bubble lows in March, according to a report out Tuesday.

Average home prices were down 2.6% from 12 months earlier, according to the S&P/Case-Shiller home price index of 20 major markets. Home prices have not been this low since mid-2002.

“While there has been improvement in some regions, housing prices have not turned,” said David Blitzer, spokesman for S&P.

Although five cities – Atlanta, Chicago, Las Vegas, New York and Portland – saw average home prices hit new lows, that’s an improvement from last month’s report, in which nine cities notched new lows, Blitzer noted.

n 13 of the 20 cities, average home prices fell in March from the year before. Atlanta fared the worst with home prices down 17.7% year over year. Home prices in Atlanta, Cleveland, Detroit and Las Vegas are all below their January 2000 levels.

Alternatively, Phoenix posted the largest gain with prices up 6.1% from last year. Other cities showing an uptick included Dallas, Denver and Miami.

Overall, the 20-city composite is down about 35% from its peak in 2006.

Experts say affordable mortgages, combined with much lower home prices, should help to bolster the housing market.

“It’s probably the best time to buy a home in decades,” said Pat Newport, an analyst for IHS Global Insight.

One Response

So lets take two people. One worked very hard and put all his money into real estate, he followed the conventional wisdom and bought the biggest house he could get a mortgage for, leaving himself deeply in debt, but after all real estate only goes up in value – that’s what they all said. You can ignore that the figures in the article don’t take into account inflation.

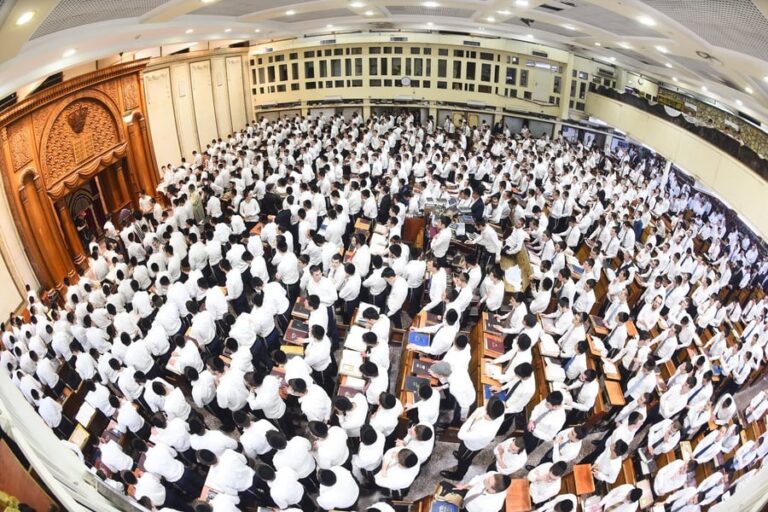

The other person managed to get by with difficulty. He spent most of his time learning, working only enough to keep his family from starving. All he has to show for his efforts are a lot of Torah, and having spent lots of time learning with his kids.