AT&T can lower the price it pays for T-Mobile USA Inc. if the remedies requested by regulators become too expensive, according to three people with direct knowledge of the purchase contract.

AT&T can lower the price it pays for T-Mobile USA Inc. if the remedies requested by regulators become too expensive, according to three people with direct knowledge of the purchase contract.

AT&T would be able to pay less than the deal’s original $39 billion value if regulators demand asset sales that surpass 20 percent of that figure, or about $7.8 billion, said the people, who declined to be identified because this clause of the contract isn’t public. AT&T could walk away from the deal and pay the breakup fee if the concessions requested top 40 percent of that value, they said.

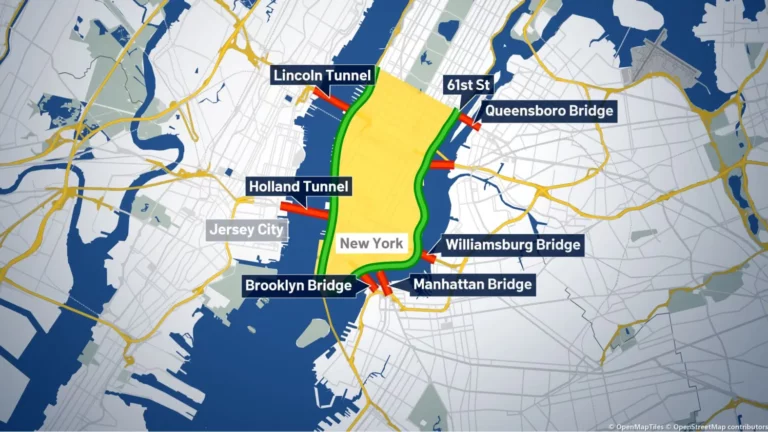

AT&T is fighting to salvage its bid to acquire T-Mobile and become the largest U.S. wireless operator after the Justice Department sued on Aug. 31 to stop the deal. The contract clauses may provide Dallas-based AT&T a means to get some T- Mobile assets at a lower price, even if it can’t get as many wireless customers or as much spectrum as originally planned.

AT&T said it will fight the Justice Department in court and has asked for an expedited hearing for the case. The company also plans to propose remedies that would make the takeover more acceptable to the agency, a person familiar with the company’s strategy said last week.

According to a March 21 regulatory filing from AT&T, the company does not have to agree to divestitures and other regulatory conditions that would have an adverse effect greater than $7.8 billion. The document contains a formula to calculate the adverse effect of each divestiture of subscribers and spectrum.