Global stock markets tumbled Monday as investors fretted over the possibility of an imminent U.S. interest rate hike and reacted to the weekend health problems of presidential candidate Hillary Clinton.

Global stock markets tumbled Monday as investors fretted over the possibility of an imminent U.S. interest rate hike and reacted to the weekend health problems of presidential candidate Hillary Clinton.

KEEPING SCORE: In Europe, Germany’s DAX was down 1.9 percent at 10,363 while the CAC-40 in France fell 1.9 percent to 4,407. The FTSE 100 index of leading British shares was 1.4 percent lower at 6,679. U.S. stocks, which had their worst day in two months last Friday, were also poised for further losses at the bell with Dow futures and the broader S&P 500 futures down 0.6 percent.

FED FEARS: The main reason behind the widespread selling in markets over the past couple of sessions is a growing fear that the U.S. Federal Reserve may be nearer to raising rates again than previously thought. Investors seized on remarks Friday by Fed Bank of Boston President Eric Rosengren that there’s a case to be made for the U.S. central bank to raise rates sooner rather than later — low rates have helped extend the stock market rally. The Fed, which last raised rates at the end of 2015, is due to meet next Sept. 20-21. Before Rosengren’s remarks, expectations of a rate hike then were low.

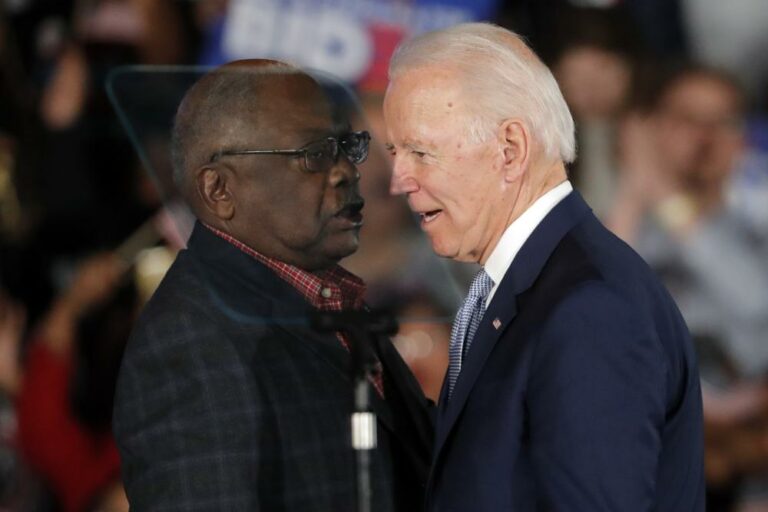

CLINTON CAUTION: Clinton’s abrupt departure from a 9/11 anniversary ceremony on Sunday added an extra element of uncertainty to already fragile global sentiment. The damage was compounded by the nearly eight hours of silence from Clinton and her team about the health scare, as well as the Sunday evening disclosure she had been diagnosed on Friday with pneumonia. The episode focused attention on Clinton’s health eight weeks ahead of the election against Donald Trump.

ANALYST TAKE: “Indices are down sharply as investors react to heightened fears about, firstly, a Fed rate hike next week and what it means for diverging global monetary policy, and, secondly, a new layer of political event risk as questions are asked about the health of Clinton and what that means for an already ‘interesting’ U.S. presidential race,” said Mike van Dulken, Head of Research at Accendo Markets.

GALAXY RECALL: Shares of Samsung Electronics tanked 7 percent to their lowest level in almost a month, after the company urged consumers globally to stop using its Galaxy Note 7 phone. The South Korean electronics giant is grappling with the fallout from an unprecedented recall of 2.5 million of its newest smartphones after several dozen of them caught fire. Over the weekend, the company urged users to return them for a replacement and a number of airlines said they would be banned.

ASIA’S DAY: Japan’s benchmark Nikkei 225 index lost 1.7 percent to 16,672.92 and South Korea’s Kospi slid 2.3 percent to 1,991.48. Hong Kong’s Hang Seng shed 3.4 percent to 23,290.60 and the Shanghai Composite Index fell 1.8 percent to 3,021.98. Australia’s S&P/ASX 200 sank 2.2 percent to 5,219.60, while the Sensex in India dropped 1.4 percent to 28,381.64.

ENERGY: The early-week uncertainty weighed on oil prices too, with the benchmark New York rate down 80 cents at $45.07 a barrel. Brent, which is used to price international oil, fell 83 cents to $47.18 a barrel.

CURRENCIES: The euro was down 0.1 percent at $1.1225 while the dollar fell 0.7 percent to 101.96 yen.

(AP)