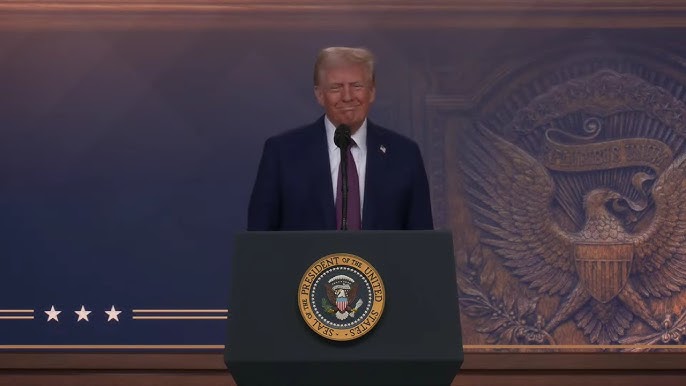

President Donald Trump called out Bank of America CEO Brian Moynihan at the World Economic Forum on Thursday, accusing the bank of not offering banking to conservatives.

“You’ve done a fantastic job,” Trump told Moynihan during a question and answer session, “but I hope you start opening your bank to conservatives, because many conservatives complain that the banks are not allowing them to do business within the bank — and that included a place called Bank of America… They don’t take conservative business.”

“And I don’t know if the regulators mandated that because of [President Joe] Biden or what,” Trump continued, “But you and [JPMorgan CEO Jamie Dimon] and everybody – I hope you’re going to open your banks to conservatives, because what you’re doing is wrong.”

Moynihan did not respond to Trump’s remarks regarding fair banking for conservatives, and instead changed the subject, telling the president that Bank of America looks forward to sponsoring the World Cup when it comes to the U.S.

Bank of America has faced multiple allegations of discriminating against conservatives in recent years.

Attorneys general from 15 states called out Bank of America’s alleged “discriminatory behavior” in a letter that condemns the de-banking efforts targeting customers for their religious and political beliefs.

A Bank of America spokesperson denied the bank has closed accounts for political reasons and said they “welcome conservatives.”

“We serve more than 70 million clients and we welcome conservatives,” the spokesperson told FOX Business. “We are required to follow extensive government rules and regulations that sometimes result in decisions to exit client relationships. We never close accounts for political reasons and don’t have a political litmus test.”

A JPMorgan spokesperson said in a statement that the bank would “never close an account for political reasons, full stop. We follow the law and guidance from our regulators and have long said there are problems with the current framework that Washington must address.”

“We welcome the opportunity to work with the new Administration and Congress on ways to remove regulatory ambiguity while maintaining our country’s ability to address financial crime,” the spokesperson said.