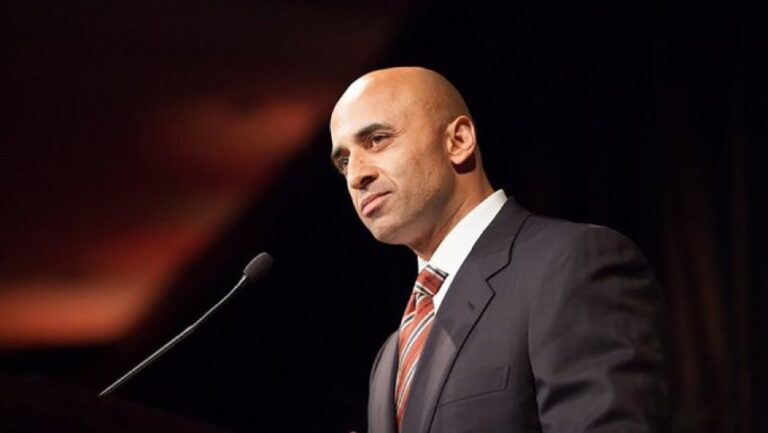

The Federal Reserve kept its key interest rate unchanged Wednesday for a third straight time, and its officials signaled that they expect to make three quarter-point cuts to their benchmark rate next year.

Speaking at a news conference, Chair Jerome Powell said that Fed officials are likely done raising interest rates because of how steadily inflation has cooled.

“Inflation has eased over the past year but remains over our longer run goal of 2%,” Powell said after the Fed’s 19-member policy committee ended its latest meeting.

On Wall Street, traders celebrated the prospect of lower rates ahead. Stock prices soared and bond yields sank after the Fed’s policymakers signaled that they envision three interest rate cuts in 2024.

In response to a question, Powell said the Fed recognizes that keeping rates high for too long, and waiting too long to cut them, could endanger the economy.

“We’re aware of the risk that we would hang on too long” before reducing borrowing rates, the Fed chair said. “We know that’s a risk, and we’re very focused on not making that mistake.”

Powell came close to declaring rate hikes over, although he refused to completely shut the door on more increases.

The central bank’s policymakers, he said, “think it’s not likely that they’ll hike, although they don’t want to take that possibility off the table.”

But he acknowledged, far more openly than he has before, that Fed officials are now discussing the prospect for rate cuts. That marked a drastic shift from just a few weeks ago, when Powell said it would be “premature” to speculate about rate reductions.

Throughout his news conference, Powell expressed optimism that inflation, which has bedeviled American consumers and businesses for more than two years, is edging down toward the Fed’s 2% target. He noted, by example, that inflation has eased in goods, housing and services — three categories the Fed has been closely monitoring.

“Inflation keeps coming down, the labor market keeps getting back into balance and, it’s so far, so good,” Powell said.

The Fed chair downplayed one concern that some economists have expressed — that the final step down to 2% inflation, from its current level of about 3%, could be harder than the previous slowdowns in price increases.

“We kind of assume that that it will get harder from here,” he said. “But so far it hasn’t.”

The Fed kept its benchmark rate at about 5.4%, its highest level in 22 years, a rate that has led to much higher costs for mortgages, auto loans, business borrowing and many other forms of credit. Higher mortgage rates have sharply reduced home sales. Spending on appliances and other expensive goods that people often buy on credit has also declined.

Conversely, interest rate cuts by the Fed, whenever they happen, would reduce borrowing costs across the economy. Stock prices could rise, too, though share prices have already rallied in expectation of rate cuts, potentially limiting any further increases.

So far, the Fed has achieved what few observers had thought possible a year ago: Inflation has tumbled without an accompanying surge in unemployment or a recession, which typically coincide with a central bank’s efforts to cool the economy and curb inflation. Though inflation remains above the Fed’s 2% target, it has declined faster than Fed officials had expected, allowing them to keep rates unchanged and wait to see if price increases continue to ease.

At the same time, the government’s latest report on consumer prices showed that inflation in some areas, particularly health care, apartment rents, restaurant meals and other services, remains persistently high, one reason why Powell is still reluctant to signal that policymakers are prepared to cut rates soon.

On Wednesday, the Fed’s quarterly economic projections showed that its officials envision a “soft landing” for the economy, in which inflation would continue its decline toward the central bank’s 2% target without causing a steep downturn. The forecasts showed that the policymakers expect to cut their benchmark rate to 4.6% by the end of 2024 — three quarter-point reductions from its current level.

A sharp economic slowdown could prompt even faster rate reductions. So far, though, there is no sign that a downturn is imminent.

In its quarterly projections, the Fed’s policymakers now expect “core” inflation, according to its preferred measure, to fall to just 2.4% by the end of 2024, down from a 2.6% forecast in September. Core inflation, which excludes volatile food and energy costs, is considered a better gauge to inflation’s future path.

The policymakers foresee unemployment rising to 4.1% next year, from its current 3.7%, which would still be a low level historically. They project that the economy will expand at a modest 1.4% next year and 1.8% in 2025.

One reason the Fed could be able to cut rates next year, even if the economy plows ahead, would be if inflation kept falling, as expected. A steady slowdown in price increases would have the effect of raising inflation-adjusted interest rates, thereby making borrowing costs higher than the Fed intends. Reducing rates, in this scenario, would simply keep inflation-adjusted borrowing costs from rising.

The Fed is the first of several major central banks to meet this week, with others also expected to keep their rates on hold. Both the European Central Bank and the Bank of England will decide on their next moves Thursday.

(AP)