After much rancor and two failed motions to proceed, the U.S. Senate unanimously passed the $2 trillion “Coronavirus Aid, Relief and Economic Security Act,” the “phase three” legislation that is intended to address the monumental economic fallout that the nation is expected to experience as a result of the coronavirus pandemic. The bill, which has been the subject of days of intense negotiation and will now go to the House, has been designed to cover various sectors of American society, including families, businesses, and nonprofits and educational institutions.

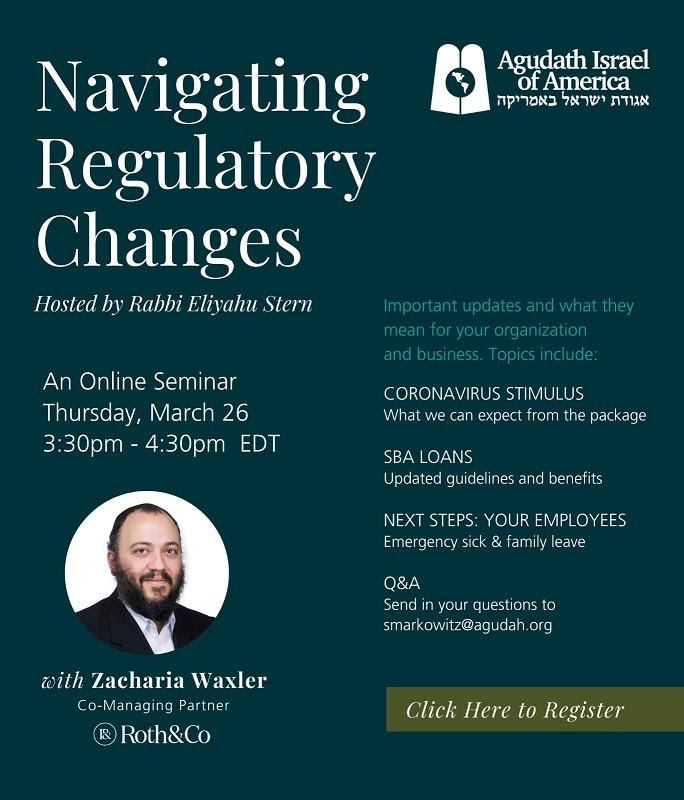

Agudath Israel of America has been working with the Administration, congressional leaders and other faith-based organizations in helping to craft the stimulus legislation. Families, religious entities and charitable institutions within the community are expected to be hard hit by the financial consequences of the contagion.

“This legislation is complex in scope and detail, with ramification for individuals and institutions in the community, Rabbi Abba Cohen, Agudath Israel’s Vice President for Government Affairs and Washington Director and Counsel said. “It is important to break down and closely analyze the elements of this bill, those favorable and perhaps not so favorable.”

After initial reading, some of the highlights of the package include:

Families — On the family level, the legislation will provide for “direct cash payments” to American households. Checks will be in the amount of $1,200 for single filers with incomes up to $75,000 and $2,400 for joint filers with incomes of up to $150,000, with phase-outs once these thresholds have been met. In addition, payments will include $500 per child. As Orthodox Jewish families are often large, this form of assistance was seen as important source of support.

Nonprofits — In addition to provisions covering businesses, a major focus of advocacy was placed on providing relief to the many nonprofits that will be negatively impacted by the pandemic. Community charities will be looked upon to address many societal needs, which will tightly stretch budgets especially at a time of diminishing contributions. The “phase three” bill addresses these challenges by expressly including charitable nonprofits in the assistance it offers vulnerable industries. It also broadens the scope of nonprofits eligible to receive loans, while also removing some restrictive conditions. Moreover, a modest above-the-line “charitable deduction” will be available to non-itemizers, as well as itemizers, and will be made permanent.

Schools — Finally, as already financially-strapped yeshivos and day schools within the community will feel the full brunt of the economic downturn, priority was given to ensure that religious and private schools were to be treated equitably with public schools in whatever programs and benefits were to be made to America’s education sector. The Senate negotiators responded positively to this concern and explicitly required a local school district to provide “equitable services” to students and teachers in non-public schools, “as determined in consultation with representatives of non-public schools.”

“Clearly, we will need further legislation to address the manifold and diverse challenges we will confront as a result of the pandemic.” Rabbi Cohen said. “But this was a critical step forward and Agudath Israel expresses its deep appreciation to Senate leaders Mitch McConnel (R-KY) and Chuck Schumer (D-NY), Treasury Secretary Steve Mnuchin, Senators Ben Cardin (D-MD, Marco Rubio (R-FL) and James Lankford (R-OK).