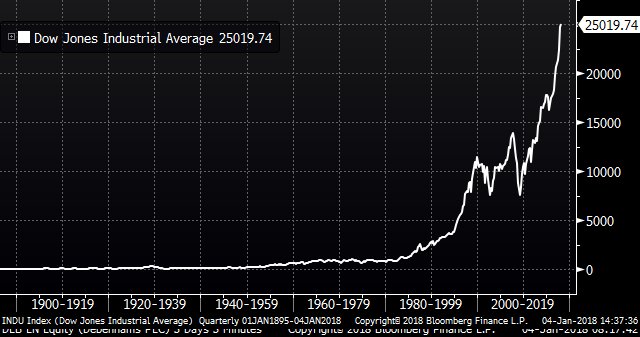

The Dow Jones industrial average is trading above 25,000 points for the first time Thursday, just five weeks since its first close above 24,000.

The Dow broke through five 1,000-point barriers in 2017, on its way to a 25 percent gain for the year, as an eight-year rally since the Great Recession continued to confound skeptics.

Strong global economic growth and good prospects for higher company earnings have analysts predicting more gains, but perhaps with more volatility.

Big gains in major U.S. blue chip companies over the past year have been powering the Dow’s relentless rise to new heights, including an 87 percent gain in aerospace giant Boeing, a 69 percent rise in Caterpillar and a 49 percent increase in Apple.

The Dow, which was founded in 1896 and is the oldest barometer of the U.S. stock market, has nearly quadrupled in value from its low during the financial crisis in early 2009.

Technology companies and banks, which put up some of the biggest gains in the last year, continued to lead the market higher Thursday. Microsoft, JPMorgan Chase and Wells Fargo posted solid gains in late-morning trading. And there was more good economic news Thursday: A report showed private U.S. businesses added 250,000 jobs last month, with smaller businesses adding 94,000.

The Dow, which tracks 30 big U.S. companies, was up 153 points, or 0.6 percent, to 25,077 as of 11:43 a.m. Eastern Time. The Dow and the other major U.S. indexes all set record highs a day earlier.

The Standard & Poor’s 500 index, a much broader index which professional investors prefer to use as their benchmark for large U.S. stocks, rose 13 points, or 0.5 percent, to 2,726.

The Nasdaq composite, which is heavily weighted with technology and biotech companies, added 15 points, or 0.2 percent, to 7,080. The Nasdaq reached a milestone of its own this week, closing above 7,000 points for the first time Tuesday.

The Dow has made a rapid trip from 24,000 points on November 30, partly on enthusiasm over passage of the Republican-backed tax package, which could boost company profits this year with across-the-board cuts to corporate taxes.

More broadly, a steady recovery in economies in Europe, emerging markets as well as the U.S. has been helping send markets higher around the globe, and indexes in some developing countries have done even better than those in Europe and the U.S over the past year. Brazil’s benchmark Bovespa is up 28 percent over the past year and the Hang Send index in Hong Kong is up 39 percent.

Bond prices sank, sending yields higher. The yield on the 10-year Treasury note rose to 2.48 percent from 2.44 percent.

Higher bond yields are good news for banks because they can charge higher interest rates on mortgages and other kinds of loans. JPMorgan Chase gained $2.01, or 1.9 percent, to $109.51 and Wells Fargo rose $1.11, or 1.8 percent, to $62.67.

Intel continued to stumble after security researchers at Google discovered serious security flaws in its computer processors. It lost $1.90, or 4.2 percent, to $43.36 after a 3.4 percent decline Wednesday. Intel said it’s working to fix the problem and that it’s not the only company affected.

Rival Advanced Micro Devices said it believes its chips are safe and its stock jumped 83 cents, or 7.2 percent, to $12.38. Most of Intel’s rivals made big gains Wednesday.

Elsewhere among tech stocks, Google parent Alphabet climbed $11.30, or 1 percent, to $1,102.82 and Intuit added $2.44, or 1.5 percent, to $161.60.

Electric car maker Tesla again said it fell short of production goals for its new Model 3 sedan, which is intended to be its first lower-cost car. Tesla has been dogged by doubts that it can ramp up production of the Model 3 to satisfy widespread demand for its vehicles. The stock skidded $8.47, or 2.7 percent, to $308.78.

Benchmark U.S. crude rose 7 cents to $61.70 a barrel in New York. Brent crude, used to price international oils, shed 7 cents to $67.77 a barrel in London.

European markets were also higher. France’s CAC 40 leaped 1.6 percent while Germany’s DAX gained 1.5 percent. In Britain the FTSE 100 edged 0.3 percent higher. Earlier in Asia, Japan’s benchmark Nikkei 225 rose 3.3 percent on the first trading day of the year. South Korea’s Kospi lost 0.8 percent while Hong Kong’s Hang Seng added 0.5 percent.

The dollar rose to 112.79 yen from 112.52 yen. The euro climbed to $1.2083 from $1.2018.

(AP)